CFDs: what they are and how they work

CFDs (Contracts for Difference) are derivative financial contracts that replicate the performance of another asset and allow you to invest against a Market Maker broker without ever passing through the underlying asset itself.

They represent a complex and particular instrument, which has had (and in all likelihood will continue to have) enormous success in Europe and Asia – in the USA, however, it is banned from the retail market – because it allows leverage and, above all, access to different markets at the same conditions. Born as an instrument used mainly by hedge funds, today CFDs are a financial product accessible to all and that can be used even by those who operate for the very first time on the markets.

Main CFDs features:

| ❓Type of asset: | Derivative with no deadline |

| 🛠Allowed: | Leverage & short selling |

| 👍Broker: | Best Online Trading Platforms |

| 📈Markets: | Stocks, Forex, Commodities, ETFs, Indices, Bonds, Futures |

| 💷Fees: | Spread and Overnight fee |

| 💰Investment: | You can start with as little as 10/20$ |

| 💪Regolator: | ESMA (Europe), ASIC (Australia), FCA (UK), |

| ⛔Risks: | Subject to leverage |

What are CFDs

CFDs are derivative contracts that allow you to invest on margin, replicating the price trend of an underlying asset. They are derivative contracts and are typically traded outside official exchanges, therefore in OTC (Over The Counter) mode.

This is the “scholastic” and traditional definition, but for those who are not already experts in financial markets, it is quite difficult to understand. That’s why we want to start with the basics and see all their features in a simpler and more intuitive way.

CFDs are:

- Derivative contracts

Like Futures and Options, contracts for difference are also derivative contracts. In fact, they do not involve the purchase or sale of the underlying asset, but simply of a security that replicates, with certain mechanisms, its value.

When we buy a CFD on Apple shares we are not actually buying Apple shares, but a contract between us and the broker, which follows the trend of the stock. In reality the mechanism is much more complex, at least behind the scenes, but we will get to that with the analysis of the other peculiarities of this contract.

- Suited for margin investing

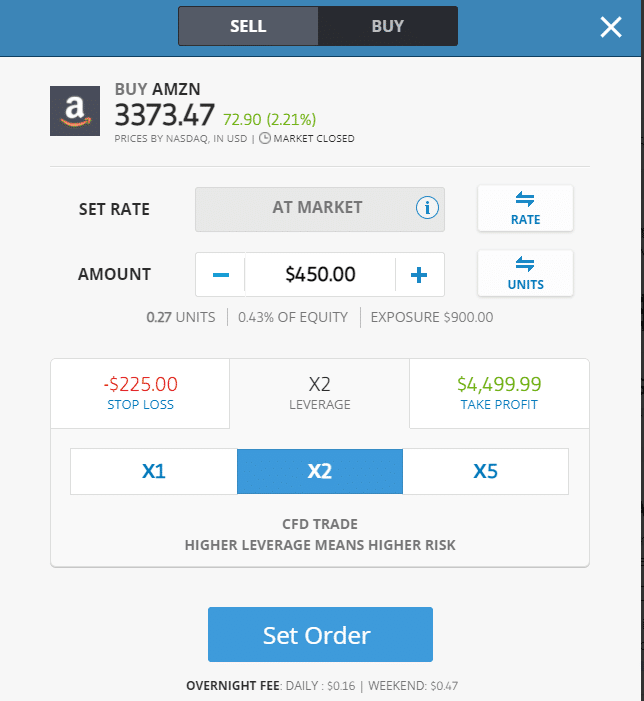

CFDs are margin investing instruments. When we open a CFD position on Amazon shares for 1,000 USD, we do not have to pay the full amount, but only the margin to cover it. If we choose to trade without a margin, the coverage will necessarily have to be 1,000 USD. by choosing a margin of 50% – i.e. a 1:2 leverage – we will be able to cover the entire investment with 500 USD. If we choose 1:5 leverage – which is the maximum allowed in Europe, for example – we will only need to cover 20% of the position, in this case 200 USD.

Different jurisdictions have different rules on leverage. While in the United States it is not allowed to trade leveraged CFDs, in Europe it is possible to invest in stocks with a leverage of up to 1:5. In Australia, on the other hand, as well as in other countries it is possible to reach a leverage of 1:50 on stocks and even 1:200 on Forex.

At TradingOnline.com we have selected and reviewed all the best brokers that allow their clients to trade through CFDs:

- eToro (here for the official site)

- FP Markets (here for the official website)

- Capital.com (here for the official site)

- Trade.com (here for the official site)

Being able to trade with leverage makes CFDs attractive to investors who do not want to lock up all the liquidity they need to conduct their trades. The margin however, as we will understand more clearly later on, is also a risk multiplier, because each movement of the security will multiply by the leverage we have applied, both positive and negative.

- Replicate the price of the underlying asset

Throughout its lifetime, that is, until we decide to close the position, the CFD will follow the trend of the asset we want to, albeit indirectly, invest in. When we choose a CFD on Ethereum (yes, cryptocurrencies can also be hedged with CFDs), we get a price at the opening of the position, let’s imagine 350USD.

As the real value of Ethereum moves, the value “carried” by the contract also changes. For the performance of our capital, net of margin, holding a CFD or holding the underlying asset is virtually identical.

Minor differences can occur when the supply and demand for a certain financial instrument are very different between the exchange where the instrument is listed and the broker you are using to trade CFDs. Especially in very “hot” moments, such as after the Brexit referendum, it is difficult for a CFD to replicate the exact value of the underlying instrument moment by moment. The difference remains small in any case.

- Traded in OTC mode

CFDs are typically Over the Counter instruments and they are not traded on regulated exchanges. OTC products are products that are not traded on a public exchange, but typically between the dealing desk (i.e. the broker) and the client. This means that the contract, being a derivative instrument, is between us who invest and the broker who has made the contract available to us.

Some states have tried to offer regulated markets to trade CFDs on the secondary market as well, imposing draconian regulations with the aim of making the market more transparent. However, very few have moved to this type of channel, mainly due to the obvious increase in transaction costs associated with such a solution.

The OTC mode can be a problem because it presupposes on the part of the investor full and total trust in the broker who also acts as a dealing desk. The CFD contract is literally a contract between two parties and there is no intermediary, state or otherwise, to standardize such contracts and above all to verify the solvency at any time of the contract in place.

A broker might sell you the CFD on a certain financial instrument, but no longer have the money to buy it when you decide to sell it. That’s why there are financial authorities, such as ESMA in the European Union, FCA in the UK and ASIC in Australia that oversee brokers. Their job is to make sure brokers remain solvent at all times and that they have insurance that covers their risk of insolvency.

However, we will be able to discuss this issue in greater detail when we look at the risks involved in this type of investment.

CFD definition

“CFDs” stands for Contract for Difference. The definition, however, aims to clarify only one of the fundamental aspects of this type of contract, namely that they are contracts that operate primarily on the difference in price between the current value of the underlying (the spot price) and the value at the time of closing the contract.

The most ignored part of the definition of CFD is the one related to the contract: we are in fact in front of a negotiation between two parties, that is between the broker and us. This contract is only between us and our broker: unlike real stocks, we cannot buy a CFD from a broker and then sell it to another person or another broker.

This feature of CFDs opens up several questions:

- They are not all exactly standard

As we mentioned, very small differences can occur between the market price and the CFD price. Although most jurisdictions have regulations on this aspect, it is possible that two different brokers, at the same time, have two slightly different prices for the same CFD.

- The broker is our counter-party

And this is what the detractors of Contracts for Difference focus on the most. Because on the one hand the broker is technically betting against us and because on the other hand he has to be the one to honor the contract we have opened. We are not in the sea of actual financial securities, where the security is worth owning and can be sold to third parties. CFDs only have value between us and the broker who issued them. They are precisely a contract between two parties.

How CFDs Work

After having analyzed the didactic and scholastic parts of these contracts, we are ready to understand how the instrument in question works, especially in everyday practice on the financial markets.

Why can CFDs be a good alternative to what is offered by the direct purchase of securities? Because they present particular characteristics that offer operativeness and tools that classic trading without derivatives and underlyings cannot offer.

- Investing on margin

It is very important, since the first appearance of this type of contracts. It should be remembered that CFDs have been widely used, especially by hedge funds, because they allowed them to cover important positions with a minimum capital commitment.

Leverage is as powerful as it is risky, because it allows you to technically invest capital that you do not have. The price difference on the leveraged investment, however, is directly reflected in the capital we have actually invested.

So if we invest 100€ on EURUSD, with 1:30 leverage, we will be exposed to the market for 3,000€. A variation of 3% in the value of the pair would mean a variation on our capital of 3% of 3.000€, or 90€. That would be 90% of the capital we have invested.

This can be very advantageous if the position we have opened is correct. We will almost double our investment with one trade and within a few hours. However, it is worth remembering that this multiplication is valid both ways, i.e. even if our position should be negative. Following the example above, we would have lost 90%.

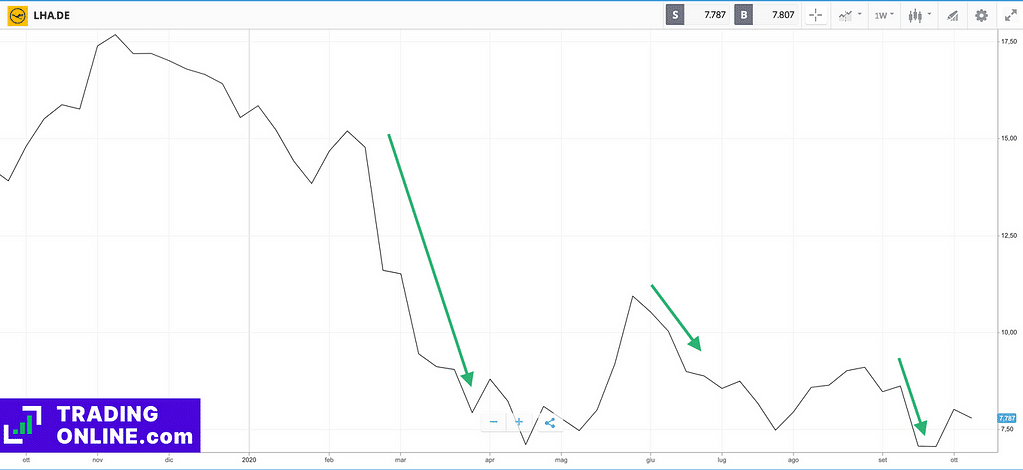

- Short positions

CFDs also allow you to short-sell. All CFD brokers also offer this possibility, which allows you to bet on the decline of the underlying asset. Do we believe that Tesla shares will have a drop in the next few days? Well, we can buy a sell or short contract from a CFD broker and then close the position when the stock has lost enough value.

This possibility is impossible to achieve if not through the use of derivative contracts, of which CFDs are the most important representatives at least for those who access the markets on their own.

- Liquidity

When talking about the functioning of CFDs we must also talk about liquidity. Let’s talk about the market liquidity, that is the possibility of finding a useful counterpart for our purchase and sale. When markets are not very liquid, i.e. not very frequented by sellers and buyers, it becomes complicated to operate on the spot, i.e. with the certainty that at any time we can get rid of the position we have opened.

With CFD contracts instead, this problem is solved upstream: our counterpart will always be the broker who sold us the contract. The OTC system presents risks because the failure of the broker would result in the futility of the contract.

However, in almost every country in the world, the financial authorities have set very clear rules against this type of eventuality. For example, the fact that client deposits must be kept in separate current accounts from company deposits. Brokers must also show their financial statements to the regulator on a regular basis to show that they have sufficient liquidity to operate. Finally, most jurisdictions provide for mandatory insurance. The risks are therefore minimal in terms of liquidity, with absolute advantages for those who choose this type of product.

- What happens when we buy a CFD

There is actually a lot going on behind the scenes when we buy a CFD, although from the investor’s side the process is one of the simplest you can imagine, as it does not vary, except in small ways, from what happens with the direct purchase of securities.

- FOR BUYERS: when buying a CFD, whether in a long position or short position, we are deciding to buy a CFD, at a certain price level (which is the spot market price of the underlying asset), with a certain leverage for a certain amount of money.

Practical example is buying $900 worth of NIO stock. From the moment we buy NIO it is trading at 45$, so a contract with 1:1 leverage will expose us to the value of about 20 shares. Instead if we choose to trade with 1:2 leverage, the contract will expose us to exactly twice as many shares, i.e. 40, and so on.

The following happens when the price of NIO changes: when the price changes, we will have to multiply the change and apply it to our real invested capital. If we had invested with a 1:2 leverage and the NIO were to rise by 3%, we would therefore have +3% x 2 = +6%. On the $900 we have invested this would be a gain of $54.

The process is identical for those who find themselves closing a position with a loss. A loss of 3% is to be multiplied by the leverage used and therefore by 2, in our example case, we would lose $45 out of $900 invested.

- FOR THE BROKER: the situation of the broker is much more complex, which can be skipped anyway for those who have no interest in understanding how CFDs work from both sides. The broker when opening a position is selling a contract, through which he commits to buying back the contract, resulting in the offsetting of any gains and any losses.

The contract it issues is valid only between the parties and with very rare exceptions – as for some brokers operating in the UK – it cannot be transferred to others via regulated markets. The broker to all effects is opening, contextually to ours, an inverse position. In case our investment is positive, the broker will settle it. In case our investment is negative, he will be the one to gain.

This type of functioning of CFDs is what makes them – according to skeptics of these contracts – unreliable and not transparent. The reality is that this does not affect the investor much, since beyond his interests the broker has to undergo important obligations for the exclusive protection of the investor as required by law in almost all countries of the world.

How to invest in CFDs

Technically we do not invest in CFDs, but we use this tool to invest in the underlying assets that are represented. Today there are several brokers that allow us to go and invest using this instrument, although in the United States they cannot be traded. On the other hand, Europe, South Africa, Australia and Asia are markets where almost everywhere CFDs are fully legitimate and they are used by millions of investors.

Several brokers propose a complete offer of products based on CFDs, allowing neutral access to all major markets. Therefore, it is enough to choose a good online trading broker (financial intermediary) that offers this type of contracts to invest via CFDs, with the modalities, caveats and above all the tools we have listed above.

Online Trading in CFDs / Trading Online in CFD

CFDs are instruments that allow you to operate by following both positive and negative trends. Their nature of derivative instruments in fact, allows a certain flexibility in decisions. In addition, they offer the possibility of using leverage.

Let’s start with the most classic position, the long one, which bets on the increase of the value of a certain asset. In this case CFDs behave in the same way as the direct purchase of securities. It will be enough to set a purchase order to have a derivative contract that will follow in every moment the official evaluation of the underlying instrument. In this case, closing the position we will have a gain in case the closing price is higher than the purchase price and vice versa.

In addition, it is possible through CFDs to short sell, i.e. to place on the market securities that we do not have in our portfolio and that are therefore “lent” to us by the broker. In this case we bet on the fall of the security, in an absolutely specular way to what we have seen with the Long position. Instead of trying to buy the securities at a low price to sell them at a high price, we will try to sell them first at a high price and then buy them at a lower price later.

Leverage plays an equally fundamental role in this mechanism: leverage in fact allows to amplify the trend of a security, creating a more pronounced volatility even on securities that are apparently very stable and on short-term movements of financial instruments.

This can be useful to those who want to trade in the short term, but not only: also those who invest in long term positions could find the multiplication of the trend of the assets on which they have bet useful.

How to trade in CFDs: some practical investment examples

We will now execute test orders, using a demo account, on different types of assets. We will place a test order on Amazon stocks, on oil as a commodity and finally on a Forex pair, EUR/USD.

- Buy Amazon Shares on eToro

eToro (official website here) is a broker for trading both with CFDs and directly with the underlying instruments. All major NASDAQ stocks are available in just a few clicks, including Amazon shares, the company headed by Jeff Bezos that has become a superstar on the American stock exchange in recent years.

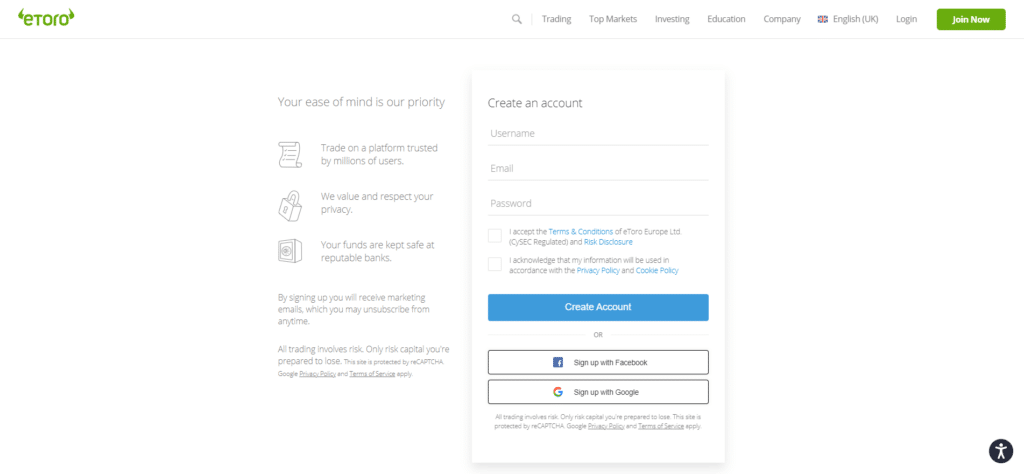

- FIRST STEP: You will need to open a free demo account with eToro account which is completely free and can be opened in minutes. In the screen you’ll find – the same as in the picture below – you’ll have to enter a username, an email address, and your password. We have to accept the conditions by checking the two boxes and then proceed to create the account. Alternatively, we can also choose to sign up through our Facebook or Google account.

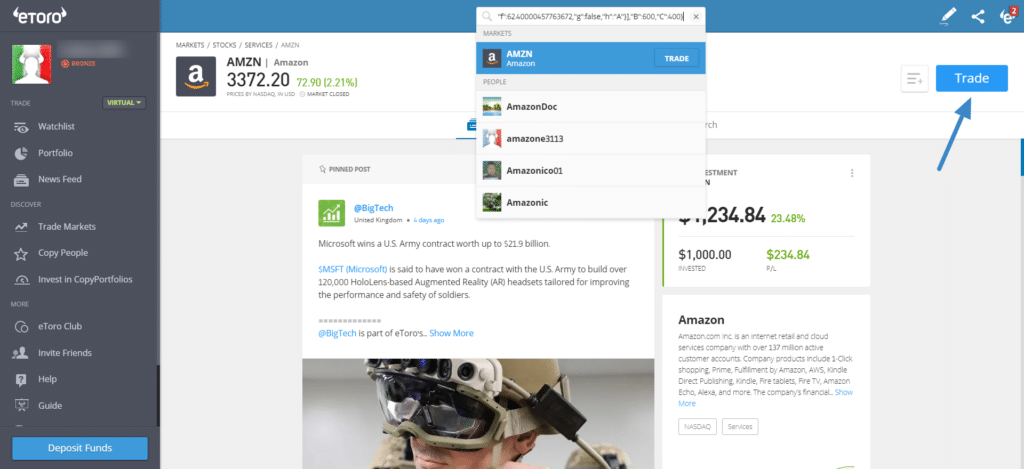

- SECOND STEP: We are officially registered on eToro. We login from the homepage, using the credentials we chose during the first step. We will then see a screen that is the main dashboard of eToro. On the left we will be able to select “Markets”, to access the different stocks. Let’s click on it.

- THIRD STEP: To access the Amazon stock you can navigate to the “Markets” page, or you can take advantage of the search bar at the top to go faster. Just search for “Amazon” and eToro will show you the stock right away.

- FOURTH STEP: Placing the order is simple. Click on AMZN, then TRADE and you will see the Amazon stock order screen. eToro offers X1 leverage to buy real shares, while choosing a higher leverage you will trade CFDs. You can also choose to buy the stock right away or place an order that will be opened when Amazon shares reach the level you selected. By clicking on SET ORDER, our position will be officially opened to our portfolio.

PLEASE NOTE: eToro only offers CFD trading to customers based where this kind of asset is fully compliant to local laws. US Citizens may not be allowed to trade on CFDs, but they can still use eToro to buy and sell regular shares.

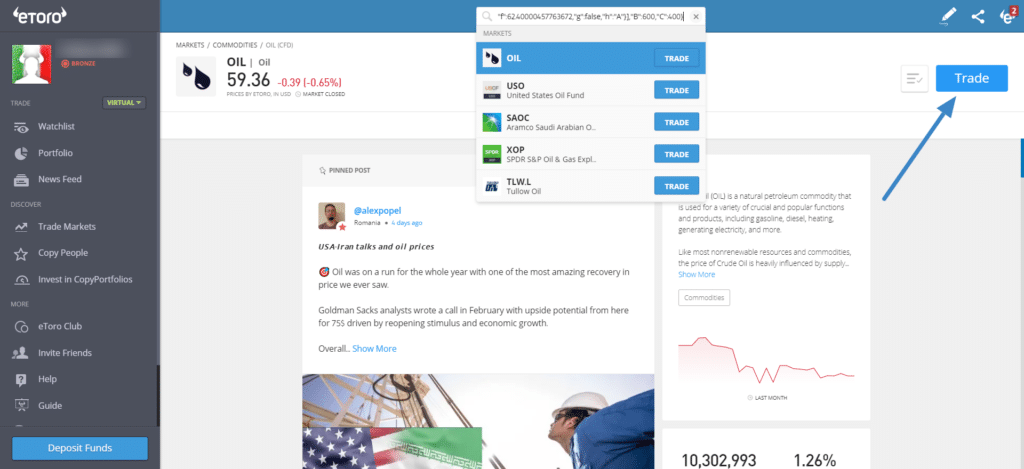

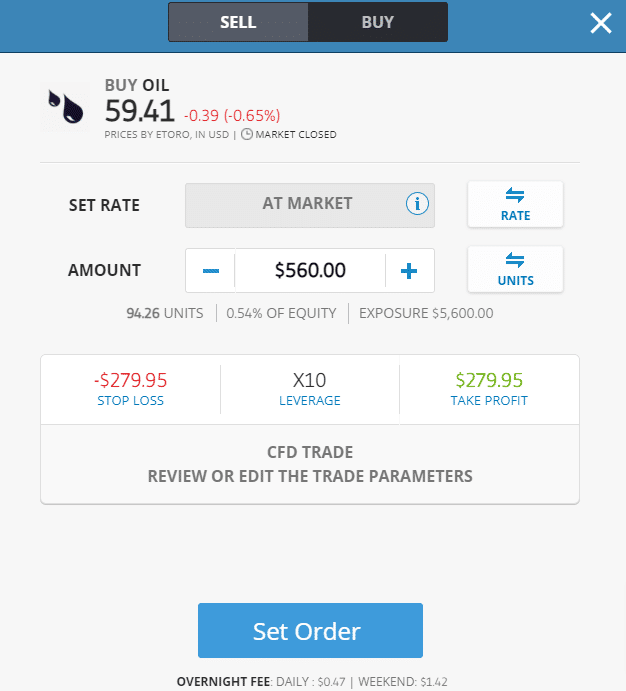

- Buy CFDs on oil with eToro

With the FREE eToro demo account we have just opened, we can also proceed to buy oil CFD contracts. Since we have already opened our demo account, we will be able to choose the asset directly from the Dashboard.

- CHOOSE OIL: Again, you can simply use the search bar at the top and type “OIL” inside. eToro considers WTI oil as “oil” in general, as Brent is not tradable with this broker’s platform.

- PLACING THE ORDER: also in the case of placing the order, provided we have clear ideas, it is extremely easy. We will have to insert the volume again to invest, the stop loss and the take profit (not mandatory) and then click on OPEN POSITION.

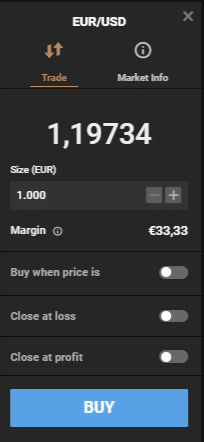

- Trading CFDs on EUR/USD with Capital.com

Capital.com is a broker that allows you to trade over 3,000 assets, including the most traded pair on the Forex markets, EUR/USD.

FIRST STEP: You can access Capital.com’s free practice demo account by simply entering the email and password you want to register with. After that, by hitting SIGN UP you will get instant access to the platform.

SECOND STEP: from the DASHBOARD, on the left menu, you have to select FOREX and locate the EURUSD pair. By clicking on “Sell” you’ll bet on a rise of the dollar, while by clicking on “Buy” you’ll bet on a rise of the euro.

THIRD STEP: to place your order, all you have to do is fill in the data of the small screen shown below. Enter the volume and set the stop loss and take profit if necessary. By clicking BUY, we can open our position.

Where to trade in CFDs

67% of retail CFD accounts lose money.

67,7% of retail CFD accounts lose money.

48% of retail CFD accounts lose money.

79,90% of retail CFD accounts lose money.

We have identified the brokers that offer the best conditions for trading CFDs today, taking into account the most important criteria to separate the adequate ones from the less adequate ones. The four indicated here are those that offer the highest level of reliability, the lowest commissions and the best access to the markets.

🥇 Best CFD Brokers

eToro is a broker that focuses on CFDs – alongside a DMA mode that allows direct buying on assets such as stocks, ETFs and cryptocurrencies. There are a total of 2,200+ assets, spread across Forex, stocks, commodities, cryptocurrencies, ETFs and index markets.

The platform is unique in its kind and it is accessible through any browser – even on Mac and Linux – directly online. There are many functionalities, but they are integrated into a platform with a consistent and easy-to-navigate interface.

CopyTrader is perhaps the most unique feature offered by eToro compared to the competition. It is thanks to this in fact that it is possible to copy traders on the platform, among those who have obtained the best results, with a single click.

The typical tools of CFD brokers, such as leverage and the possibility to sell short, complete the framework. All markets on eToro are equally accessible: investing in US stocks has almost identical conditions to investing in other European markets.

The spreads are very competitive, especially on stocks – and the broker additionally offers a demo account for free, which can be tested without any kind of hassle and limitation with virtual capital of 100,000 USD.

Let’s remember the importance of the demo trading account: it allows you to trade in virtual mode, thus allowing you to learn this discipline, accumulating experience without using real money.

| Platforms: | Webtrader, App (iOS and Android) |

| Type of assets: | Forex, Stocks, ETFs, Commodities, Indices, Crypto |

| Tradeable assets: | 2.300+ |

| Main feature: | CopyTrader |

| Official Website: | https://etoro.com |

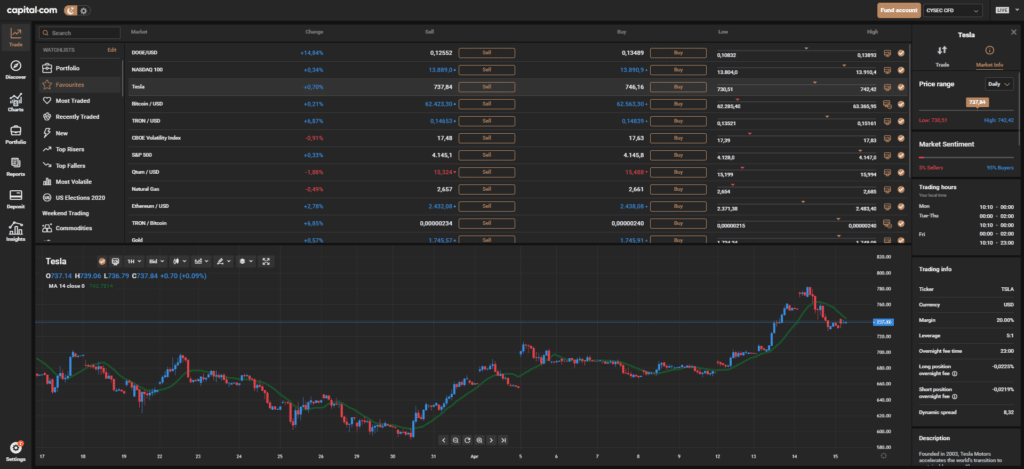

Capital.com is an exclusively CFD broker, licensed to operate in Europe in the UK. It offers thousands of assets, spread across the markets of Forex, stocks, commodities, cryptocurrencies, ETFs, indexes and even futures.

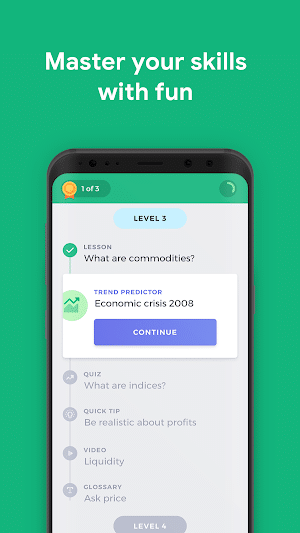

Also in this case, the broker offers a platform accessible via web and also via the App both for iPhone and Android devices. In addition to the Trading App, there is also Investmate, a platform created for educational purposes and which offers the possibility to learn directly from case scenarios that have actually happened in the real world.

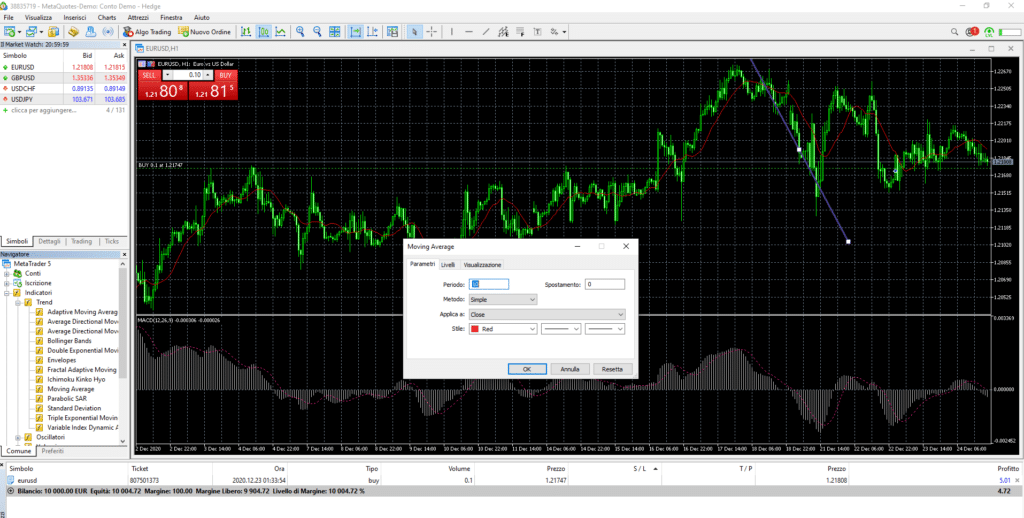

Capital.com offers a free demo with 1,000 USD of virtual capital, which can be increased at any time. With the demo account you have the possibility to access most of the markets available on the platform. Not only that, but through the demo account you can also try out the other two platforms (TradingView and Metatrader 4) that Capital.com offers to clients. Both are free and will allow you to take advantage of algorithmic trading and other tools for advanced traders.

| Platforms: | Webtrader, App (iOS and Android) |

| Type of assets: | Forex, Stocks, ETFs, Commodities, Indices, Crypto, Futures |

| Tradeable assets: | 3.000+ |

| Main feature: | Investmate, integrated AI |

| Official Website: | https://capital.com |

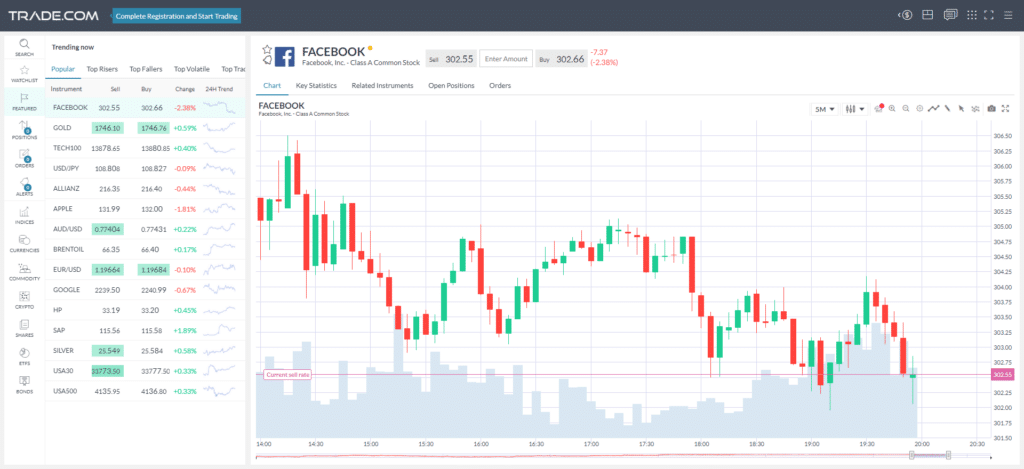

Trade.com is a multi-asset broker, with an extensive offer of CFD securities on different categories of underlyings. Stocks are definitely the strong point, offered on a large number of markets and with extremely competitive spreads.

Among the other markets on which it is possible to invest with this broker we also find Forex, cryptocurrencies, bonds, ETFs. For a broker that as a whole has to offer over 2,100 securities on different markets, many of which are almost unobtainable elsewhere.

The choice of platforms is also excellent for Trade.com. The proprietary web platform is flanked by MetaTrader, a trading platform recognized as the best by professional traders. You can access the Trade.com platform from here, with enough capital to test the potential, especially in terms of market operations and spreads.

| Platforms: | Webtrader, Metatrader |

| Type of assets: | Forex, Stocks, ETFs, Commodities, Indices, Crypto, Bonds |

| Tradeable assets: | 2.100+ |

| Main feature: | Metatrader, very tight spreads |

| Official Website: | https://trade.com |

FP Markets is an Australian based broker that now offers its services in Europe as well, by virtue of a license obtained in Cyprus (but also holds the Australian ASIC license). A broker that has made the extreme depth of its CFDs offer on stocks which is one of its main strengths.

There are in fact over 11,000 stocks, the bulk of which are distributed on the stock markets of the USA, Australia, Hong Kong and London. Under the rest of the markets FP Markets has a lot to offer as well, with a decent depth on Forex as well. Completing the picture is the dual platform MetaTrader plus IRESS Platform, the second of which is intended for those who want to trade via CFDs but in DMA pricing mode and therefore with fixed commissions.

You can test them in the free demo, limited to the MetaTrader version, which is still the basic one for those who want to trade in CFDs.

| Platforms: | Webtrader, Metatrader |

| Type of assets: | Forex, Stocks, ETFs, Commodities, Indices, Crypto, Bonds |

| Tradeable assets: | 11.000+ |

| Main feature: | Possibility to trade small-cap and mid-cap stocks |

| Official Website: | https://fpmarkets.com |

Investing in CFDs: 👍Pros and 👎Cons

Like all financial instruments, CFDs are not perfect. Their use is recommended when you want to make an investment of a speculative nature using leverage, also taking advantage of the possibility of selling short. Let’s see what their pros and cons are, when they can be useful and when they are not.

PROs of CFDs:

- Low limits for investing

CFDs, especially when they are traded on leverage, have the great advantage of being able to offer access even to those who want or can invest little. This allows you to build well-diversified portfolios even with a few hundred euros.

- Neutral access

There are no preferred markets for CFDs. On the contrary, the structure of the contracts and the associated costs and commissions allow us to invest neutrally on all markets that may be of interest to us. This freedom cannot be guaranteed by any other instrument currently available on the markets and accessible even to those who are not millionaire investors.

- Short selling

We consider it to be an even more useful tool than leverage, which remains important when it comes to CFDs. Thanks to short-selling in fact it is possible to ride out negative trends that otherwise, in direct purchase mode, are impossible to exploit. However, there are also some CONs of CFDs, which must be carefully evaluated before choosing this type of instrument for your trading operations:

- Costs

By choosing unsuitable brokers it is possible to incur costs that are much higher than those of classic brokers. Overnight commissions are not always clear, even in this case when one does not use a correct and adequate trader.

- Inexperience

The possible use of tools such as leverage by inexperienced traders can result in significant losses. Of course, this is not the fault of CFDs, which simply provide a tool. The fact remains that those who are not able to control themselves or are thinking of approaching the markets without a precise strategy may be tempted by CFDs to take greater risks than necessary.

Is it worth trading CFDs?

Yes, we believe that CFDs are tools that effectively allow everyone to trade, at a very low cost and with access to markets otherwise beyond the reach of small investors.

It is undeniable that they are instruments of absolute and total democracy on the financial markets, offering the same opportunities both to those who invest significant capital and to those who do not have much to invest.

Of course, this does not mean that they are instruments suitable for everyone, but the fact that they are not hyper-safe instruments and that they shield the saver from any possible loss should not be misleading. Those who choose to invest freely and without the typical protections of managed savings, choose to run more risks but also choose to keep in their pockets the bulk of the commissions they would otherwise have to pay.

Characteristics of CFDs

There are some things that you need to know before you start investing in CFDs. Let’s go through them one by one, while also comparing these characteristics peculiar to CFDs to what is offered by other financial assets.

Expiration of CFDs

CFDs have no expiration date, at least when the underlying asset is not subject to expiration. When we invest therefore in Forex, Stocks, Commodities (not in futures version), Cryptocurrencies and ETFs the contract can absolutely be considered as perpetual.

The situation is different for those CFDs that instead have, as underlyings, securities with an embedded maturity. This is the typical case of futures, as well as bonds that can be traded through CFDs. All the best brokers offer a particularly clear prospect of the eventual expiration of a CFD, thus allowing us to organize our trade taking into account this very precious information.

When a CFD expires, if it is scheduled to expire, the position is rolled over. The broker will automatically credit or debit the difference necessary to replace the just expired contract with an identical one, but with a future expiration.

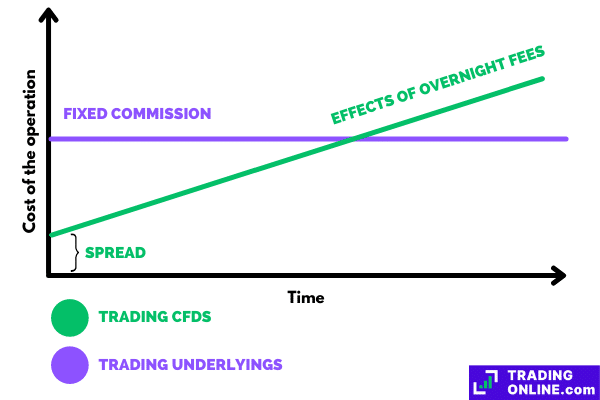

CFDs: Costs and Commissions

CFDs are subject to two types of commissions that affect the cost of the contract both when buying and selling, and when a trade remains open from one day to the next.

In fact, all CFD brokers operate by applying a spread, which is the differential between the actual market price and the price charged on the platform. We will deal with this specific type of commission in CFD trading in a moment.

Then there are the overnight commissions, which are due for every position held open after the markets close. In this case, an annual interest rate is applied, divided on the day, to which a further (and small) spread is applied by the broker itself. All brokers report, at the moment of the order, a precise quantification of the quantity of overnight commissions that will be charged on the position.

CFD spreads

CFDs do not incur trading costs similar to the fixed costs we typically see when purchasing securities directly through bank brokers. This of course does not mean that CFD brokers offer services completely free of charge. The commissions that are collected by brokers offering CFDs take the form of spreads, that is, the difference between the actual spot price on the market and the one we can find on the platform.

The following example may help to understand the actual scope of this type of commission. If the price of ENI on the stock exchange is 7.04 EUR for the purchase and 7.06 EUR for the sale, the broker tends to offer on his platform more divergent prices, in the form of 7.03 EUR and – always as an example – 7.06 for the sale. The difference between the real price and the price charged by the broker is called spread or differential.

Spreads can be fixed or variable, i.e. they can remain constant over time or be raised and lowered by the broker depending on market phases. Usually, brokers with variable spreads tend to raise them in moments of particular volatility: it is a way for the broker to protect himself and avoid exposing himself directly to easy gains by the client.

CFD assets

CFDs owe part of their popularity to the fact that they can have practically all asset classes available through the financial markets as underlying assets.You can invest via CFDs in:

- Forex

Forex trading is largely done through CFD contracts, which allow not only to apply a maximum leverage of 1:30 on the main pairs, but also to have very convenient tools for short positions. Although technically we are used to considering this type of contracts as separate from CFDs, technically they are, and the same characteristics and commissions are applied to them as we are used to seeing for classic CFDs.

- Stocks

As far as trading in shares is concerned, CFDs have the enormous advantage over DMA purchases of being able to offer the investor neutral access to any type of market. Our reference is obviously to the overseas markets, on which, for clear and understandable reasons, bank brokers practice decidedly important commissions.

With CFDs, access is by the same means, whether you want to trade on a stock listed in Paris, in Hong Kong or in the USA. CFDs on equities have therefore offered many small investors the possibility of linking their investment to markets that were once inaccessible because they were prohibitively expensive and difficult to operate.

- Commodities

Here, too, CFDs have played the role of making life easier for retail traders. Until the arrival of CFDs on the markets, it was practically impossible for small and medium-sized investors to trade on contracts which, dry, required minimum investments starting from lots of 100,000 USD.

CFDs, on the other hand, allow fractional investment even on this type of product, freeing up access for those who want to bet on oil, gold, natural gas but also on soft commodities without having large amounts of capital at their disposal.

- ETFS/ETF

It might seem curious that passively managed funds, which often incorporate leverage, can be CFD underlyings. This actually shouldn’t come as a surprise to anyone who has tried trading CFDs on ETFs. Because we still have access to lower commissions and we can take advantage of leverage other than that which may be embedded in the security. Lastly, thanks to CFDs we can also sell short the value of an ETF.

- Cryptocurrencies

Investing in cryptocurrencies without resorting to CFDs presents major problems that must be taken seriously. Without CFDs, the only plausible alternative is cryptocurrency exchanges, virtual hubs that are often not registered as financial intermediaries and therefore offer far fewer guarantees.

In addition, CFD brokers charge on average much lower commissions, making investing via these contracts more profitable all-round than buying Bitcoin and altcoins directly.

- Bonds

Bonds, a classic investment banking instrument, can also be traded via CFDs. The advantages in this case compared to the classic investment is certainly constituted by the possibility of applying leverage, on products that tend to move very slowly at price. The bonds typically traded by CFD brokers are the American ones, with the possibility of sometimes also finding some European securities.

- Futures

Futures are also products that are sometimes listed by CFD brokers. Futures are derivative contracts themselves, and it may seem counter-intuitive to buy a derivative on another derivative. Here again, the advantage may lie in what are the strongest pieces for CFD traders: lower transaction costs, instant liquidity, and the ability to comfortably act short as well.

- Indices

Almost all brokers that deal in CFDs deal in contracts that replicate the performance of a stock market index, as well as sometimes certain regional indexes or even baskets of assets, such as the VIX/VXX volatility index.

CFD’s, along with ETF’s, remain among the very few tools that a small or medium-sized investor has to trade these benchmarks, again, therefore, offering something practically unique in the investment scenario for independent traders and perhaps not with large amounts of capital to invest.

Trading in CFDs: actual opinions and reviews.

CFDs are instruments that can trigger very different reactions, even among the most experienced investors. We will provide our version and opinions, which have matured over years on the markets (which have also included the use of instruments of this type), also indicating which may be additional sources of interesting and informed opinions.

Are CFDs a scam?

No, CFDs are not by their essence a scam: they are regular contracts, which are traded by plenty of more than legitimate brokers and which are also registered as legitimate traders in Europe, the UK, Australia and South Africa, much of Asia and South America.

Therefore, it is absolutely not possible to automatically associate CFDs with fraudulent schemes. However, as in almost all areas of the investment industry, there is a possibility that malicious parties may exploit the popularity of these specific securities to organize real scams.

Let’s start with the fact that since the 2000s CFDs have grown in popularity and today most investors, no matter how small or untrained, are familiar with them. Unfortunately, there are also brokers that are not registered in Europe – with fanciful offices in the Caribbean or Pacific islands – or even clones of legal brokers that offer (fake) CFD-style trading.

Therefore, if it is true that CFDs do not automatically mean scams, it is equally true that the fact that CFDs are present on a platform – whether real or fake – does not make you safe from possible scams. These are the most typical cases.

- CFDs used in the domain name

Most of the “brokers” with a website that includes the word CFD have, over time, almost always turned out to be scams – not exactly cleverly organized either. You can find fictitious names or names that follow those of regular brokers.Broker che operano al di fuori dei confini europei

There are two types of offshore brokers: those that operate in legally respectable countries and therefore can be considered reliable and those that operate with offices – real or fictitious – in tax and legal havens.

In both cases, it is better to avoid having any kind of relationship with those brokers who are not authorized in Europe. In the second scenario, we are most probably dealing with 100% fraudulent systems.

As with anything that may affect our assets, it is best to be very cautious. Because the world is full of those who exploit the popularity of online trading and CFDs for fraudulent purposes, even if they are organized in criminal groups.

CFD TrustPilot

Trustpilot remains a very important site for those who want to hunt for reviews, most of the time trustworthy reviews, on brokers that offer CFDs and therefore are the main channel for those who want to choose this type of instruments.

- FP Markets: 4,9 on Trustpilot

FP Markets gets one of the highest scores among the financial brokers present on Trustpilot. It is a clear sign of a first-class focus on its customers, whether it is investing in DMA Pricing mode, or in dry CFD mode.

- Capital.com: 4,3 on Trustpilot

The score obtained by broker Capital.com, is also very high, a clear sign of the quality of the services offered by this specific broker. We are therefore in line with what is reported, also in other locations, by those who have actually used this broker.

CFDs Opinion Forum

There are forums where users exchange opinions and advice on CFDs on a daily basis. We recommend two of them, here it is easy to consult quality threads and above all to study in depth some issues that may concern this type of contracts.

- Forex Factory: a forum dedicated to Forex trading through CFDs that boasts a very active community;

- BabyPips.com: a long-standing point of reference for speculative traders, where they discuss brokers, investment strategies and analysis

- MQL Forum: created by MQL, the same company that owns and manages Metatrader, it is arguably the most active community talking about CFD trading.

Learn CFD trading

Trading in CFDs largely follows the same operating rules as investing in the direct purchase of the stock. However, there are certain differences, which arise from the additional tools that contracts for difference offer to those who use them.

Therefore, we have collected courses, insights on strategy and market analysis, video courses and books that can help us learn more about the world of CFD investments.

CFD courses + Free Pdf

We have chosen the best courses that also deal with CFDs, as well as delve into the topics needed for those who want to trade in the financial markets. All the resources mentioned below are free to consume and can be accessed easily on Youtube or other open access platforms.

- Free 1215 Day Trading course (available on Youtube)

1215 is a company that specializes in day trading and CFD education. Unlike many “gurus” present in this niche area, it does not make promises of big gains and in the content the risks of day trading on derivatives are clearly explained.

The free course that the company has made available on YouTube consists of 10 lessons, each covering a different topic. For someone who is just starting to get into CFDs, this is a practical and easy-to-follow resource that covers all the important basics.

- Investmate (free app from Capital.com)

Investmate is a completely free app, available for both iOS and Android. Inside you’ll find lots of little lessons about investing, financial markets and CFDs. The app is organized into topics, each of which is in turn divided into lessons. This organization helps you learn exactly what you’re interested in when you’re interested, making sure you grasp the learning concepts with quizzes from time to time.

The best thing about Investmate is that the authors are renowned and reliable.The creator of the app is Capital.com, a very serious broker operating in Europe and the UK with regular CySec and FCA licenses. This guarantees the accuracy of the information, the experience of the authors and the validity of the content.

You can choose what you want to learn from 30 different major topics. Each topic is further divided into lessons that can be taken in a few minutes, and then you can take a quiz to check your progress. This is a great tool for people that have little time to learn about CFD trading and want to maximize the amount of information they can learn during that time.

- Official paper of ESMA (available here)

ESMA (European Securities and Markets Authority) is the highest European authority on financial laws and regulations. In February 2013, it published this official paper giving information about CFDs, especially from a legal point of view. The paper uses language that is easy to understand, it uses a very concise structure that presents the concepts with clarity.

Although it is only 5 pages long, it is an interesting read especially for European investors. Undoubtedly, ESMA has a neutral standpoint and is not interested in making you use or avoid CFDS, just like we do. It is always better to avoid learning from sources that have a conflict of interest with what they are teaching about the financial markets.

CFD Analysis

Both technical analysis and fundamental analysis can be used successfully by those who want to trade CFDs. They are two different approaches, these are based respectively on mathematical study and the analysis of the economic environment. Here below, we would like to present both of them.

- Fundamental analysis

Fundamental analysis can be qualitative, when it analyzes non-numerical data that may have an impact on the future value of a security, or quantitative, when it starts with numbers and numerically verifiable data such as balance sheets, P/E ratios or the GDP of a nation.

Analyzing CFDs with fundamental analysis is exactly the same as applying this type of analysis on the underlyings. When we invest in stocks via CFDs, we have to apply the tools of fundamental analysis specific to the stock market. The same applies to commodities, Forex and all other markets. In this case the fact of trading derivatives does not matter. The price analysis – long term in this case – should be done without any particular differences between derivatives and underlyings .

- Technical Analysis

Also as far as technical analysis is concerned, there are no substantial differences between the study of CFDs and the study of underlyings. The important thing is the type of underlying we have chosen, since the CFD faithfully reproduces its price, adding only a very small spread.

Therefore, tools such as trading indicators, chart analysis and all the assistance that a good trading platform can provide in the application of algorithms and automatic analysis are of fundamental importance. Depending on the asset you are trading, you might want to focus more on technical or fundamental analysis. The Forex market is often regarded as one of the best to apply indicators, while stocks are more influenced by fundamentals and news.

CFD trading strategies

It is usually said that CFDs are particularly suitable for short-term strategies since overnight commissions make it inconvenient to keep positions open for long periods. This is not necessarily true, at least in relation to what those who trade with little capital can afford to do.

A long-term position can be just as convenient with CFDs as with brokers who charge a fixed commission between buying and selling the financial product. Typically, there are no trading strategies that should be excluded from the list of those that we can use with CFDs and financial markets of this type.

As far as short-term trading strategies are concerned, CFDs have always been the preferred instrument of those who operate in such contexts. This is because the absence of fixed trading commissions makes it less expensive to open and close many positions during the same trading day.

Compared to trading in direct purchase, moreover, it must be underlined that CFDs allow to intervene also on negative trends, thanks to short selling, which allows you to bet on the fall of the underlying.

Choosing CFDs therefore increases the strategies available to those who want to trade online, not reduces them. For some types of operations – let’s imagine for example a position on shares with a ten-year horizon – it could be more convenient to operate with another type of instrument. But these are evaluations that need to be taken from time to time.

Free video courses on CFDs

We have chosen three different video courses, short but enriched with information, which can help us understand more about what the functionalities and features of CFD trading are.

- CFD Trading Course by TradeCFDs

A very extensive video course, composed of 93 lessons, in which all the theoretical and practical aspects that can be useful for an investor to better understand CFDs and the way they are traded are covered. There are also very interesting parentheses on strategies and different approaches that can be used to improve performance. For a free course published on Youtube, this has a really considerable amount of content.

- CFD Tutorial on Trading 212 by Mitch Investing

A very short and 100% practical video. The author, a day trader already well-known on Youtube, explains exactly how to use CFDs within a trading platform. After you have seen all the theory in our guide, you may want to take a look at the practical way they are traded. The video also mentions the percentage of investors losing money on CFDs, and explains the most common reasons behind their lack of success.

- Avoid CFD Trading by Money Unshackled

Surely many will find it intriguing that we have included a video that is basically against CFDs. Instead, we find it extremely educational, because even with some exaggeration, this video highlights critical points that we believe should be taken into due consideration when trading with these specific instruments. As it is always better to hear different opinions, we think that this can be a valuable video for you after all we have talked about in our guide.

CFD Trading: Best Forums to Learn

We mention here the most active forums that can offer a more concrete foundation for those who want to learn how CFDs work.

- BabyPips.com: a forum entirely dedicated to Forex trading through CFDs, here you can find many interesting strategies to try;

- MoneySavingExperts: dedicated more generally to saving money, but with hundreds of threads dealing on educational aspects including CFD trading. Since most of its users are American, you sometimes hear about brokers who don’t offer CFDs;

- CityWire: a forum created in Great Britain, which surely deserves to be mentioned because it is a gold mine of information and didactic tools for CFDs;

- Reddit: learning on Reddit is possible, also thanks to the constant work of dissemination by active users in the markets. Also here, in the subreddits dedicated to the world of finance, you can find several insights into the world of CFDs. Consider checking r/investing, one of our favourite subreddits about financial markets and how to approach them.

Why invest in CFDs?

There are several reasons why thousands of new investors go down the CFD route every day. On the one hand, it is true that many companies in the industry are active with effective promotional campaigns that attract investors, but it is not just marketing: it is mainly the substance that is appreciated by traders.

It is clear from the simple evidence: millions of investors continue to prefer this approach to the markets over the classic one. There are several undeniable advantages that can answer in detail the question of why to invest in CFDs.

- Neutral access to markets

Neutral access is one of the main values of CFDs, although it is often ignored. Having the possibility to invest in Frankfurt, or on the Nasdaq, or even on the Hong Kong stock exchange under practically the same conditions is a huge advantage over what “traditional” banks and brokers offer.

We can choose any security, based only on the actual convenience it has for our portfolio, without having to limit ourselves to avoid the high commissions that are charged by bank brokers. This is why CFDs are considered a more democratic approach to day trading and investing, as opposed to what we were used to before they became popular.

- Access to distant markets

Furthermore to neutral conditions, it is also the ability to access markets that would tend to be closed to us. It is beneficial to have Chinese stocks available, or even access to agricultural commodities and cryptocurrencies on the same platform.

This is one of the main advantages that has built the great success of CFD trading brokers: millions of Italian and European investors have suddenly found themselves with instruments that can make them invest in markets that were once inaccessible.

- Low investment limits

We are talking first of all about the very small amounts that CFD brokers ask for to open an account; but we are also talking about the possibility to have fractional orders and therefore to invest even a few euros to expose oneself to an action that would be worth, if bought in full, hundreds of euros.

Even the detractors of CFDs must necessarily admit that these securities have meant for many people the possibility to start investing, even without important capital behind them.

The competitive advantage of CFD brokers over traditional ones is also given by the trading platforms. When brokers make use of proprietary and self-developed platforms – as the broker eToro does excellently -, the tools that are offered to the investor are of higher quality than the banking platforms.

When platforms like MetaTrader (unanimously considered the best for online trading even by professionals) are offered, the competitive advantage of CFDs and brokers offering them becomes even more evident.

- Short Selling

For many, short selling is a dangerous tool both in the hands of professionals and, above all, in the hands of those who invest as a hobby or as a side job. In reality, short selling allows everyone to bet on negative trends that, as history teaches us, repetitions occur in the world of finance. We are in favour of personal responsibility and we are especially in favour of providing everyone with the right tools to invest.

It will then be up to the individual trader to decide whether or not to stay updated and well informed, i.e. whether to decide to approach the markets with all possible rationality, or not. Just consider that all evidence-based research points to the fact that short selling is an effective way to price a financial asset correctly.

CFD quotation: how it works

The quotations of CFDs follow, net of the spread, the official quotations of the underlying indicated by the contract. The trend recorded on the Nasdaq, for example on Airbnb shares, is the same as the trend of the CFD on Airbnb.

The only possible deviation is the spread, which is precisely the differential that the broker applies with respect to the official market price. This spread, as should be known at this point of our discussion, is usually extremely reduced, except in cases where markets are particularly volatile, with brokers who give themselves some more freedom.

However, by overlapping the official quotations with those provided by any broker, it is possible to see how in reality the quotations are very similar. Differences may occur, in the range of a few pips, when markets are volatile and unstable. Knowing this behaviour of CFDs, you can choose not to trade them in the minutes following an IPO, the results of a general election or when very important macroeconomic data is published.

CFD taxation

Taxation on CFDs depends on the country where the investor resides. Even within the European Union, where many laws are made equal for all member states, the rules differ from country to country. Generally speaking, CFDs are normally taxed on capital gains. This means that when you sell the contract at a higher price than you paid to buy it, thus generating a capital gain, you have to pay taxes on that gain.

However, there are also CFDs that pay dividends, such as those on stocks: in these cases some countries tax them as capital gains, others as dividends. Finally there are countries, such as Cyprus and the UK, where taxation is highly favorable and close to zero. Most legislations allow traders to deduct losses from profits, so that they are only taxed on their net profit from their operations.

Final thoughts on CFDs

CFDs are a subject that often divides: there are those who consider them the solution to every kind of problem for small investors and those who consider them a high and very high risk instrument and to be reserved only for the most experienced.

As is often the case, the truth is in the middle: it is by no means true that CFDs are the ideal tool for everyone, just as it is not true that, with the right knowledge, they cannot also be used to mitigate the risks.

CFDs must be considered as an opportunity offered by the markets today to have more tools for financial trading than we had yesterday. It is largely up to us to decide if and how to operate, what risks to take and ultimately what type of use to make of the contracts for difference.

To make things understandable for everyone, just consider tennis and golf. In tennis, a player uses just one racket the whole game and for the most part of his career as well. In golf, every time the player hits the ball he chooses the most suited club to do so. Investing is like playing golf, not tennis: every time you want to trade, there is an optimal asset to carry your operation. CFDs are one of the tools that you can use, if your country allows it, to manage your investments.

©TradingOnline.com has offered an objective opinion, which allows you to know the true functioning of CFDs, including elements that are often not explained. Are they the right tool for everyone? Certainly not. But it is equally sure that the world of online investments has also been enriched thanks to these tools.

FAQ CFD Trading: Frequently Asked Questions and Answers

What are CFDs?

Contracts For Difference are derivatives that follow the price of the underlying asset and allow fractional investments, short selling and use of financial leverage.

Are CFDs risky?

It depends on the type of underlying. Without leverage they present the same degree of the market risk as the underlying reference. The more leverage you use and the more volatile the underlying asset is, the more risk you take.

Is it legal to invest in CFDs?

It depends on the country you reside in. In the United States it is not legal for brokers to offer CFD trading; in Europe, Australia, South Africa, the United Kingdom, most of Asia and Latin America it is 100% legal. Check the website of the financial authority of your country to know about what laws are in place where you live.

Which brokers offer CFDs?

Among the best ones enabled to operate in Europe, there are eToro, Capital.com, FP Markets and Trade.com. eToro is also available in South Africa, in the UK and in the Seychelles. You can trade using eToro in the USA as well, but in this case you won’t be able to trade CFDs.

What assets can I trade using CFDs?

Forex, Stocks, Commodities, ETFs, Indices, Cryptocurrencies, Futures, Bonds. Some brokers also offer CFDs on options and vanilla options.

What commissions are charged on CFDs?

You pay a small spread between the ask and bid price, as well as an overnight fee for positions held open after 11 p.m.

How much money does it take to start investing in CFDs?

On average, brokers require a 100 €/£/$ deposit to open a live trading account. Depending on the broker itself, minimum deposit can be as high as 10.000$ or as low as 10$.