Guide

Financial Leverage

Leverage is a tool offered in Forex and CFD investments, which allows to multiply the performance of the asset in which we have invested.

Created as a tool for Forex trading, nowadays it is available on all CFDs, ETFs and other types of derivative instruments, Futures and options. Financial Leverage can be a useful tool to increase the volatility and price movement of financial security or to be able to expose ourselves to positions much larger than the capital we can commit.

Although many consider it to be a shortcut to greater gains in online trading, leverage is a double-edged sword that must be handled with extreme care by the investor.

As far as the European continent is concerned, the maximum leverage that can be applied to each asset class is set by ESMA, which has intervened repeatedly in recent years to limit the margin provided by this tool, at least for non-professional clients.

Financial leverage – Main features:

| ❓Why it is used: | Multiplying fluctuations, heding, trading on margin |

| 🤔Assets: | Forex, stocks, ETFs, derivative contracts, commodities, cryptos, indeces |

| 💰Costs: | Overnight fees depending on the interest rate |

| ⛔Risk | High |

| 👍Where can you use it: | Best online trading platforms that allow trading on margin |

What is financial leverage: definition

Financial leverage is technically a loan from the broker, which allows us to make larger investments than we could make using only our capital. Our capital will be used as collateral. If the loss of the total capital we have invested exceeds our collateral, the position will be closed automatically. If we make a profit, it will be calculated on the total amount we have invested (guarantee and borrowed capital).

Let’s see how this mechanism works:

- Technically it is a loan

Whenever we open a leveraged position, we are in effect getting a loan from our broker, who usually relies on external liquidity providers to ensure that all his clients never run out of money to borrow.

If we buy with 1:5 leverage 1,000 euros of Apple shares, we will be exposed for 5,000 euros in the market, automatically borrowed by the broker (and its liquidity providers). The 1,000 euros we have committed will be used to hedge against changes in the price of the stock.

If we buy with 1:5 leverage 1,000 euros of Apple shares, we will be exposed for 5,000 euros in the market, automatically borrowed from the broker (and its liquidity providers). The 1,000 euros we have committed will be used to hedge against changes in the price of the stock.

- Multiply profits and losses

Depending on the leverage we are going to use, this tool will multiply the performance of the stock we have chosen. Let’s take the example of an investment in stocks, on which we have chosen to apply a leverage of 1:2.

Our capital will have to cover 50% of the total investment and if the stock rises by 5%, we will obtain a total gain of 10%, that is 5% x 2. However, the trend is multiplied even in case of loss. If the security we have chosen and on which we have invested with 1:2 leverage were to lose 5%, we would find ourselves with a net -10% in capital, for the same principle as above.

- Legal restrictions apply

There are different laws around the world regarding leverage. Within the European Union, for example, the relevant financial authority is ESMA. ESMA has limited by law the leverage that brokers can offer to non-professional clients, so for example on stocks you usually get a leverage of 1:5.

In the U.S., the Commodity Futures Commission has imposed a maximum leverage of 1:50. This level of leverage can only be offered on the most liquid Forex pairs, while for the rest of the Forex pairs it drops to 1:20 and the value drops further for instruments such as stocks and ETFs.

In the UK the maximum leverage is limited by the Financial Conduct Authority to 1:30; in Australia ASIC has recently limited leverage to 1:20 and each nation has its own rules on this. However, there are jurisdictions that offer very generous rules, especially in Pacific atolls and exotic nations, where leverage easily reaches as high as 1:200 or 1:500.

- Hedging tool

Leverage is often used for hedging positions, that is, making investments that hedge the risk of others. It is in this case a tool for complex strategies and, at least among professional investors, it is the most frequent reason why leverage is used.

Financial leverage: how exactly does it work?

Leverage has practical applications that today can only interest small and medium investors: it is no longer a tool reserved for complicated inter-bank operations but a possibility offered by a large number of brokers and intermediaries even in retail investment accounts.

- How leverage works in Forex

The currency market lends itself because on the one hand it is relatively stable, and on the other hand because it is a necessary market for many to hedge against the foreign exchange risk of other types of investments denominated in foreign currencies.

In most jurisdictions, Forex enjoys higher limits on leverage because it is believed that this market is less risky than others. Applying leverage to any Forex order will result in a net multiplication of the performance of our investment.

Therefore, leverage in Forex can be used for those who are looking for higher returns while exposing themselves to higher risks. Alternatively,financial leverage in the currency market can be used for hedging purposes, for example, to cover the risk of buying a package of shares in an exotic currency.

- Financial leverage in CFDs

CFDs are derivative instruments that allow you to invest in different types of underlying assets, from commodities to stocks, passing also through ETFs, bonds, stock market indices and cryptocurrencies. This type of contracts can integrate a financial leverage that can be chosen by the investor at the time of opening the trade when placing the order.

The principle of operation is the same as we have seen in Forex. In fact, we can choose any leverage point – within the maximum set by law – and multiply the performance of the underlying asset we have chosen. Contrary to what happens with ETFs, with CFDs we can choose how much leverage to apply to a single investment.

The reasons for hedging can also be valid in this case, choosing for example a notoriously anti-cyclical asset like gold. Being able to have leverage helps to expose yourself for larger positions than you can actually support with your capital.

- Leverage in ETFs

ETFs, increasingly popular instruments, often already incorporate financial leverage. In this case, the result is obtained thanks to complicated synthetic replication schemes, with the result of being able to offer those who want products that already have a prefixed leverage.

Therefore, it is not uncommon to find securities on the market that already incorporate financial leverage at 2, 3, 5 or 7 on assets that replicate the performance of oil, or natural gas or other commodities.

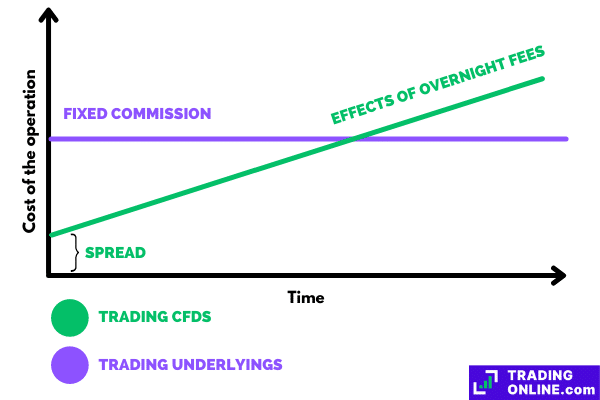

- The cost of leverage

Financial leverage is technically a loan and therefore has its own interest costs, which should be carefully considered before setting an order. In fact, for both Forex and CFDs there are so-called overnight commissions, i.e. daily commissions in the form of interest that are charged at the end of each trading day.

We have to remember that these commissions, which are always due when trading with this kind of instruments, are calculated having as “taxable base” the whole position, i.e. the whole exposure after the application of leverage.

If we invest on EUR/USD with a leverage of 1:30 1.000 euro, we would be exposed for 30.000 euros in total. The overnight fee should be calculated directly on the 30,000 euro exposure. The differences in cost compared to an investment without leverage should be considered. The best day trading brokers offer a preview of this cost already in the order phase, allowing us to better assess the impact of commissions.

- The risks of leverage

Financial Leverage, as a multiplier of the positions we have in the market, amplifies the risk. Each loss will correspond to a loss multiplied by the level of leverage that we have chosen.

To a greater potential gain always corresponds a greater exposure and therefore a greater risk of losing money. For this reason, we must, before exposing ourselves to this instrument, evaluate the risk we are willing to run in the hunt for a certain level of profit.

Leveraged Investment Examples

We will now do two different examples of leveraged investing, one on Amazon shares and one on gold, using two of the different brokers.

Leveraged investing in Amazon shares with eToro

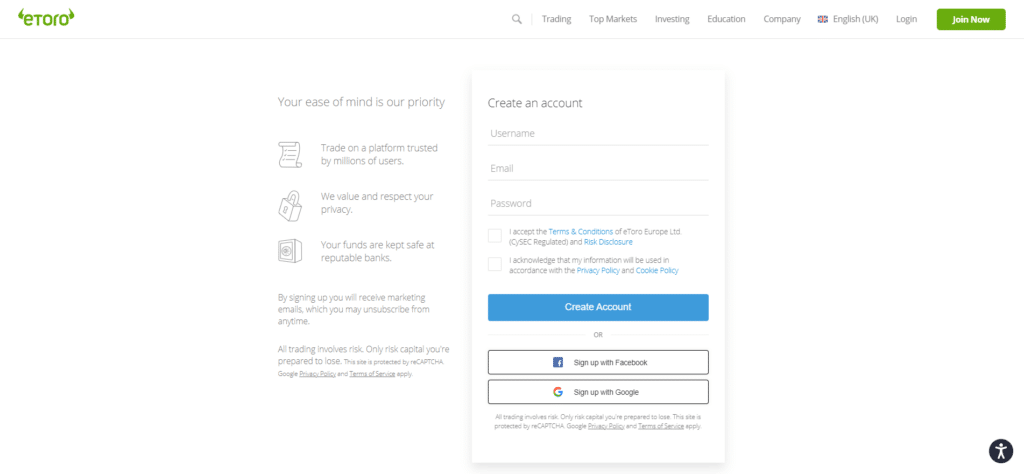

- First step: get a demo account with eToro

To test our first order we will need a free eToro demo account, an account that provides 100,000 USD of virtual capital that we can freely use for this purpose. After signing up, we can move on to the next point.

- Second step: login to the eToro platform

The second step is just as simple. Using the credentials we chose during the registration phase, we will be able to make our entry into the proprietary trading platform that is offered by eToro.

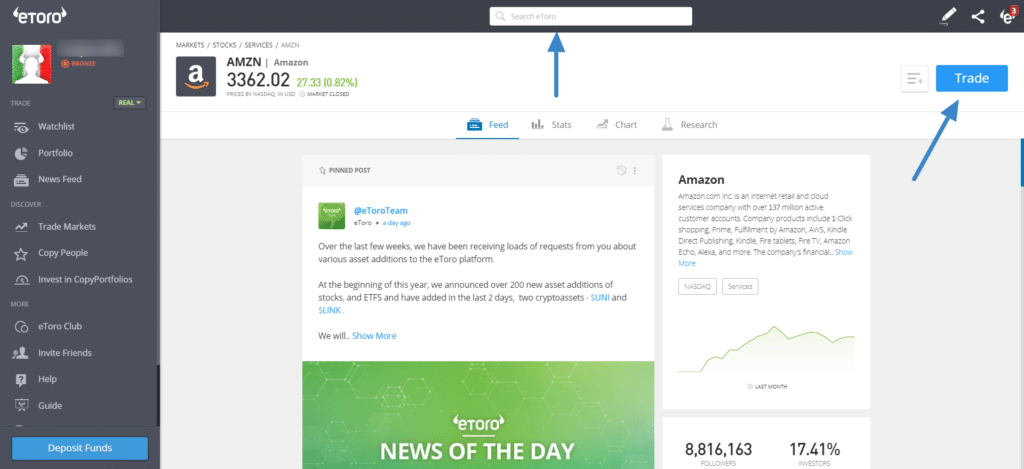

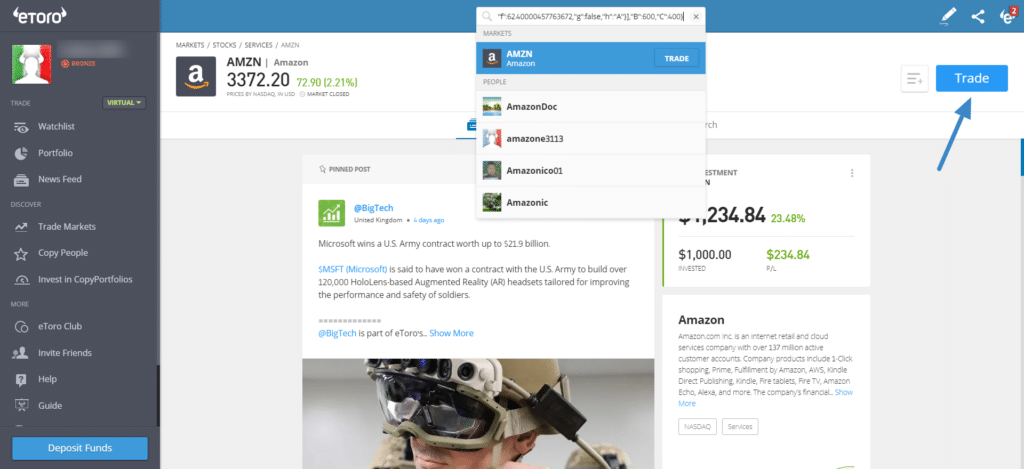

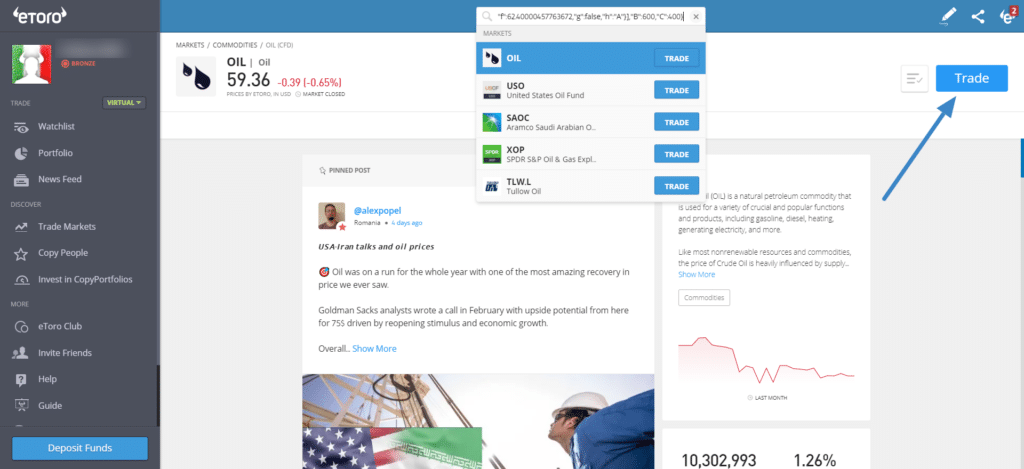

- Step three: we locate Amazon shares

Amazon shares are listed at NASDAQ and we will be able to find them on eToro via two channels. We can use the search that is positioned at the top of the interface, or follow the path Markets>Stock>NASDAQ>AMZN. In any case, once we have located the relevant stocks on the screen, we can click on TRADE NOW to place our leveraged order.

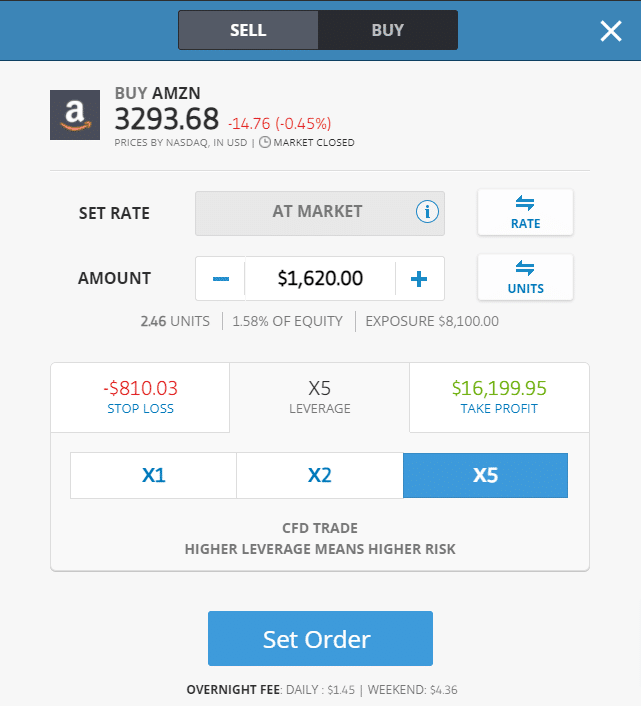

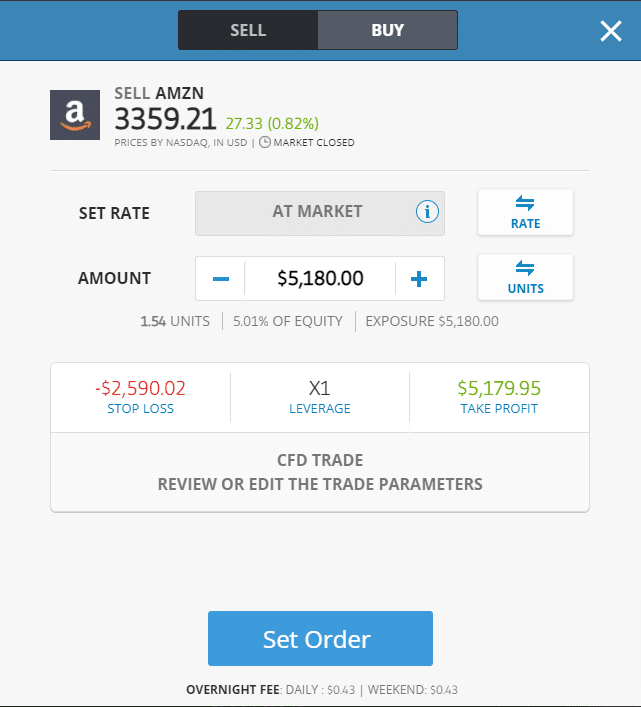

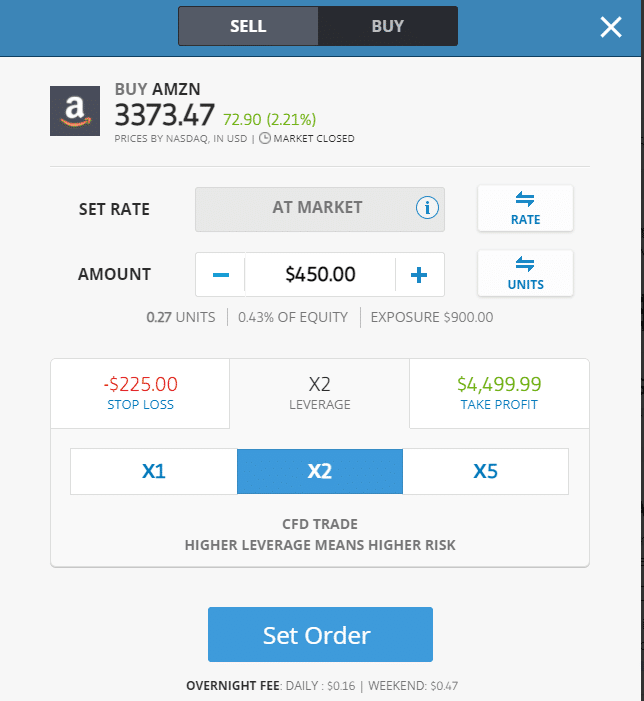

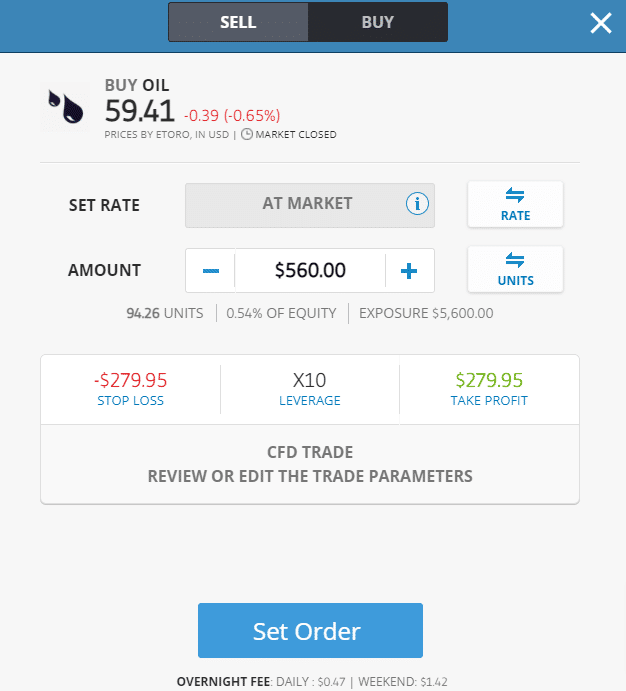

- Step four: enter the Amazon stock order with leverage

From the screen you see further down you can enter the volume of money or number of Amazon shares to buy, any stop losses and take profits and then set the leverage. eToro allows you to choose between x1 leverage (no leverage), x2 leverage and x5 leverage on stocks in general. We choose the one that best matches our investment strategies and move to an Open position to start the order, which will be immediate.

Note that this broker reports the cost of overnight commissions resulting from the use of leverage, i.e. interest on borrowed money. However, the costs are very small: on a 4,540 USD position in x5 leverage, we are paying 4 USD per day, less than 0.001% of the invested capital.

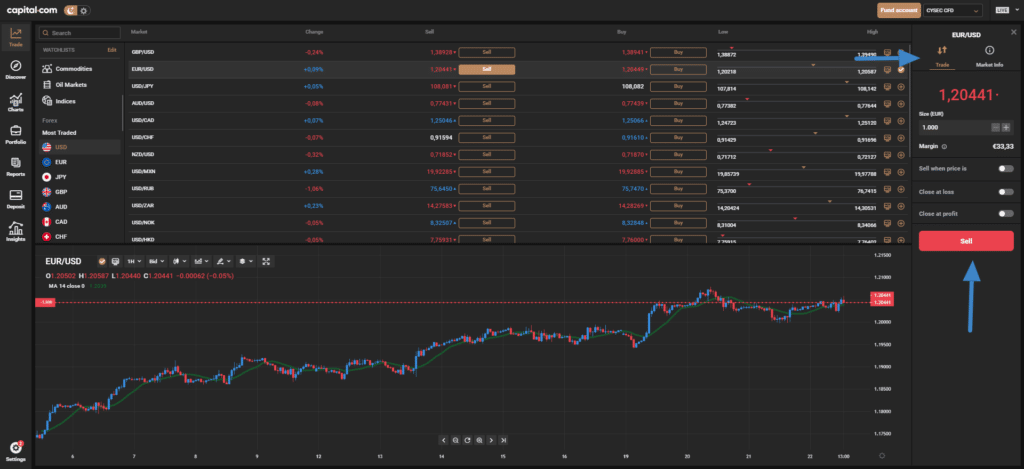

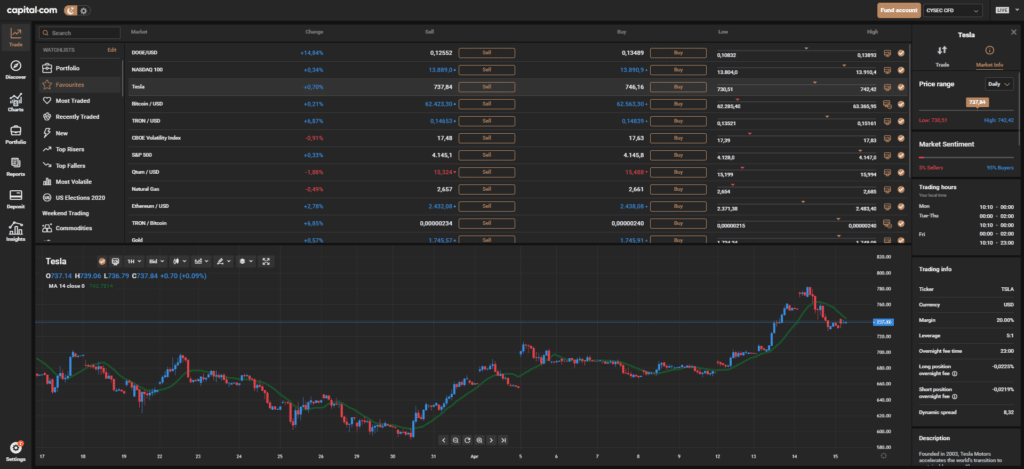

Buy GOLD on Capital.com with leverage

Capital.com has another way of approaching the issue of leverage and does so by automatically inserting the maximum possible leverage on each order, with the maximum that can be contained by going to modify the platform settings.

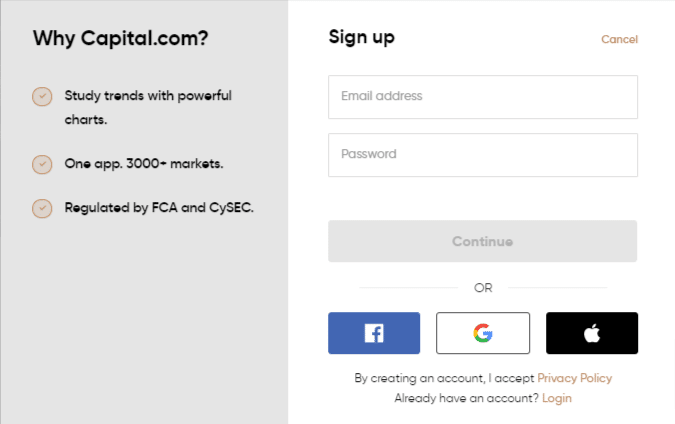

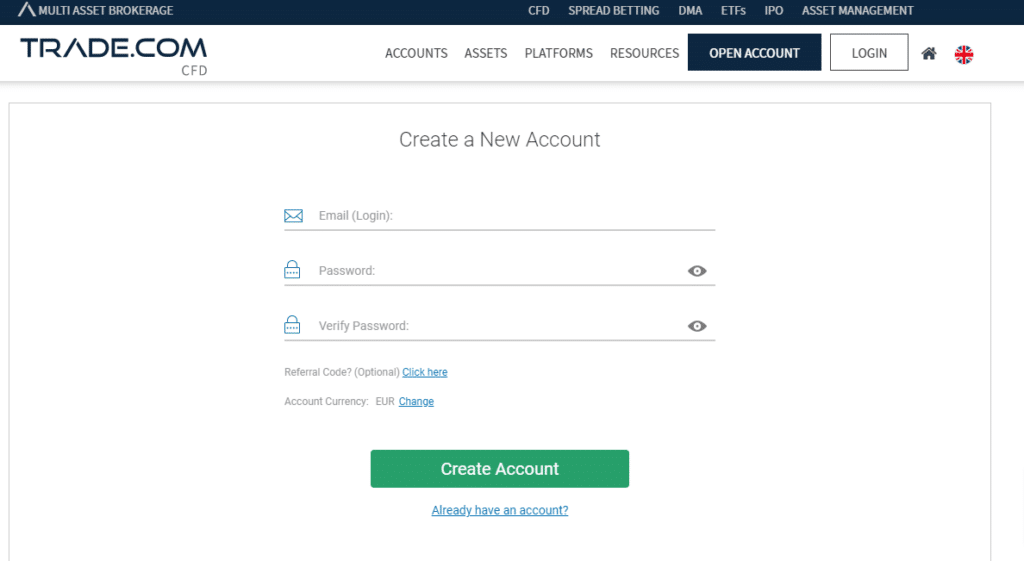

- First step: sign up for a demo account with Capital.com

Here we can open the demo account with Capital.com, which allows us to get 1,000 USD test capital to invest in any type of market that is offered by this broker. Once we enter our email and chosen password, we will be diverted directly inside the investment platform of this broker.

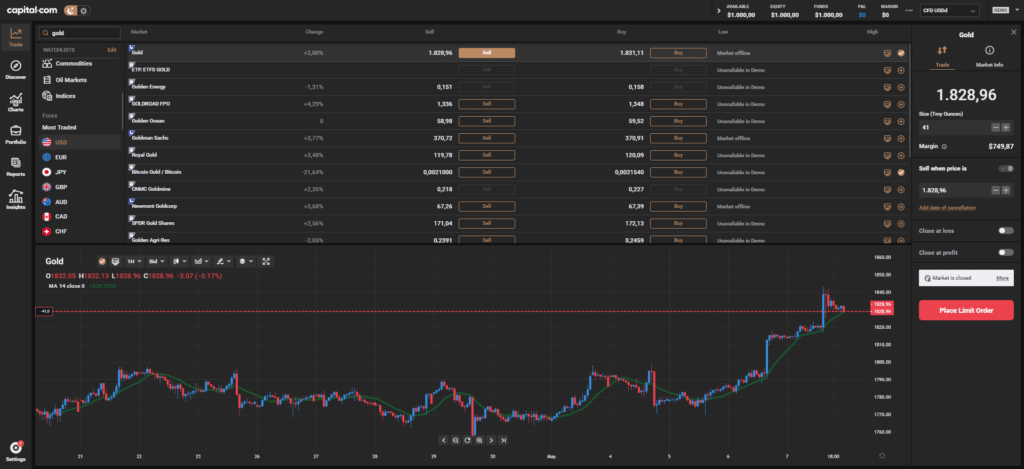

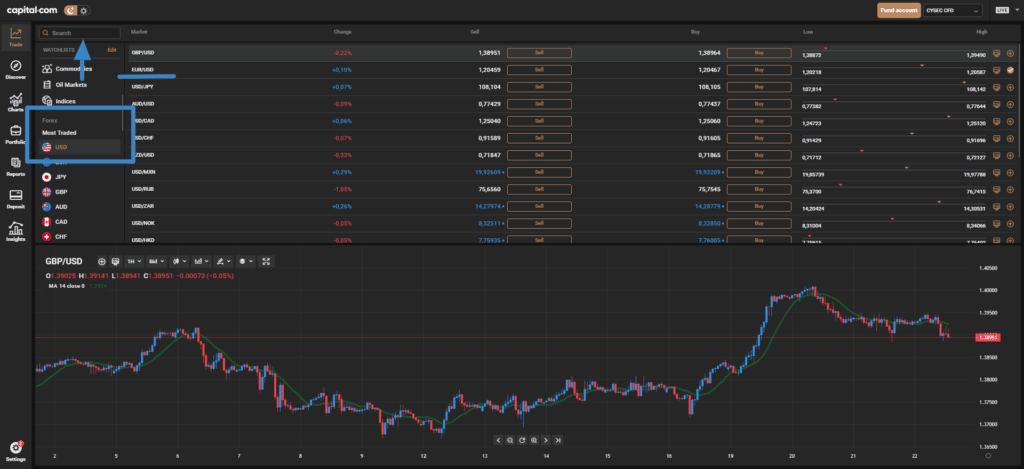

- Second step: finding gold on the platform

We can find gold on the platform offered by Capital.com by going to the menu on the left, choosing “Commodities“. Just click on it and then choose GOLD. Let’s click BUY to proceed.

- Third step: place the order

After we have chosen gold, on the right column we can insert our order measured in ounces. Under the quantity we will also find the indication of the margin, i.e. the amount of money we are going to commit to go and buy the certain amount of gold we have indicated.

The functioning of this broker is very particular in this sense because it is not possible to modify the maximum leverage applied during the order phase. To do so, we will have to go to Settings > Trading Options and then change the leverage applied from the screen that we have shown below. The change can also be done on an order by order basis. Once we deem the appropriate leverage and other details of our order correct, we can move on to the order by clicking BUY.

Best trading platforms with financial levarage [TOP LIST 2021]

[broker]

All the best European Forex and CFD brokers offer leverage within, in trading platforms jurisdictions where it is allowed by law. Let’s also see what their main features are outside of leverage.

It is one of the most popular brokers in the world and allows you to go and invest in over 2,100 securities, spread across stocks, Forex, commodities, cryptocurrencies, ETFs and indices. It offers a CFD mode for all leveraged investments, while also offering a DMA (Direct Market Access) mode on Stocks, ETFs and Cryptocurrencies when you choose to trade without leverage.

In relation to what is offered by this broker in terms of leverage, we should definitely highlight also the possibility to invest by spending very small amounts in terms of overnight commissions. The commissions and operations of eToro can also be checked with its free practice account, which allows you to invest freely under the same conditions as real accounts.

In relation to what is offered by this broker in terms of leverage, we should definitely highlight also the possibility to invest by spending very small amounts in terms of overnight commissions. The commissions and operations of eToro can also be checked with its free practice account, which allows you to invest freely under the same conditions as real accounts.

Capital.com is a Forex and CFD broker that applies maximum leverage limits on all the products it has listed. In Capital.com’s free demo account it is also possible to trade with higher levers, which are those guaranteed to those who log in as professional investors.

10,000 USD (renewable) of virtual capital, proprietary platform and access to over 3,000 securities complete the picture of a valid broker that has many satisfied clients in Europe, as evidenced by the reviews of both our staff and the most reliable third-party sites.

FP Markets is a multi-asset broker that operates with different levels of leverage in the various countries in which it operates. The service is particularly focused on offering Forex pairs, American, Australian and Hong Kong stocks, with a minimal selection of securities from other markets as well.

Highly professional broker, offering both MetaTrader for its CFD section and IRESS for its DMA pricing mode, to reduce spreads to the very core. You can test the demo account here with 100,000 USD of virtual capital.

Trade.com is a multi-asset broker with over 2,300 securities listed, which also allows access to leverage in all the jurisdictions in which it is present. To trade with Trade.com you can choose between MetaTrader and the proprietary web platform, without any kind of restriction on the level of leverage you can apply. You can test on the demo account here free of charge and above all with commissions and leverage that are identical to those that we can then use during the trading phases with real capital.

Characteristics of financial leverage

Financial Leverage is a way of investment where the bettor has to cover only the “margin of movement” of the price and not the entire position. It is a way of operating typical of derivative contracts, which leads to advantages that we have already partially explored and that at least in the applications of the best brokers, has really interesting features.

- Modularity

The real revolution of online trading platforms, especially those that operate with CFDs, has been to leave carte blanche to the investor to apply the leverage he prefers. This translates into greater flexibility in investments, better adapting to the risk profile of each investor.

- Short term amplification

One of the most frequent problems for those who want to invest in the financial markets is not having enough volatility on the markets to do very short term trading. In this sense leverage can be of great help to those who want to invest in scalping or intraday mode. A variation of 0.5% on the value of an action, for example, becomes a variation of 10% on the capital we have invested if we have decided to use a leverage of 1:20.

- Risk management tool for hedging

Risk management is very important for those who want to create portfolios and investment strategies. The fact that leverage can be used as a cheap hedging tool makes it very convenient for those who want to hedge against risk. Once upon a time, only the big hedge funds thought in these terms, but now virtually anyone could manage to hedge against currency risk using CFDs and leverage.

- Simple to use

Platforms have made great strides in the last few years and today they make it very easy to apply leverage to any type of order. Even a novice user can usually figure out how and where to intervene in the interface to make the desired trade.

In most cases, it all comes to to clicking “2x” or “5x” or any other amount of leverage that you want to use. Most platforms also allow you to know in advance how much interest you will owe on the borrowed capital when you open your trade.

Financial Leverage: Formula

The leverage formula is the simplest we can find to calculate within the world of finance.

Typically it is expressed either in the form of 1:x (where 1 represents the capital used as collateral and X for the total capital actually invested) or in the form of x2-x3-etc. or in the form of a multiplier. Nothing changes for calculation purposes, because we will have to multiply:

- Capital committed to the position x with applied financial leverage

And therefore multiply, in the case of a 1.000 euro position with 1:10 leverage, 1.000 by 10, obtaining 10.000 euro which will be the effective exposure on the markets.

If we have a broker that gives us leverage in the form of a multiplier, as in the case of x3, X4 and so on, we can do the exact same calculation. On a position of 1,000 euros in x10 leverage, we will have to multiply 1,000 x 10 to get the actual exposure of 10,000 euros.

Financial leverage calculation: a few examples

The calculation of leverage is not complex. Let’s imagine that we have invested in Apple shares with a leverage of 1:5, i.e. a leverage multiplier of 5. Let’s also imagine that we have invested 1,000 USD in this position.

- In the case of a 2% increase in the value of Apple shares

We will have to multiply 2% by the value of leverage and we will get 10%. We will have earned 10% of the capital actually committed, i.e. 1,000 USD and therefore we will have earned 100 USD, against an actual movement of the stock of only 2%.

- In the case of a 3% decrease in the value of Apple stock

We will have to multiply the leverage x5 by the percentage value of variation, that is 3%. We will have 15% in total, which will have to be subtracted from the capital actually invested, and therefore -15% of 1,000 USD. We will therefore have lost 150 USD of our investment.

Forex financial leverage

Financial leverage is a structural part of Forex, both because it allows multiplying the typically small fluctuations of this market and because hedging strategies are often used to hedge currency risk.

Although leverage is regulated differently by individual nations’ regulations, normally Forex is the market where brokers are allowed to offer the highest leverage. This ranges from 1:30, as in Europe, up to even 1:500 as offered by many FSCA regulated brokers in South Africa.

Leverage is essential in the world of Forex because currencies have very small fluctuations on a day to day basis. If their trend were not multiplied by leverage, it would be virtually impossible to get interesting returns from this market.

Leverage within the Forex market can be, as well as in other markets, applied to short positions: in this case, the operation is absolutely specular – because there will be an amplified gain in case of a fall in the exchange rate and there will be a loss in case of an increase.

Leverage also has the great merit of being able to offer an immediate increase in volatility even for pairs that travel on particularly stable prices, thus allowing even those who invest in the short and very short term to get enough movement to trade.

As far as the link between hedging and leverage is concerned, thanks to this instrument we can protect ourselves, for example, from the exchange rate risk we would have to bear by investing in assets denominated in currencies other than the one we normally use. This is the typical example of investments to hedge positions in commodities, ETFs, bonds and equities listed on emerging markets.

Banks and financial leverage: what to know

When we talk about leverage in the banking sector, we are actually in a very different field from the one we have dealt with so far. The leverage ratio of banking institutions is in fact the ratio between the institution’s net capital instead of the total assets.

It is a good indicator of the risk profile faced by a banking institution. If a bank has a leverage ratio of 1:10, for example, it means that for every $10 deposited by its depositors, the bank uses $9 to finance mortgages, loans and other operations. The more liquidity the bank can invest, the more interest it can generate; on the other hand, this also means that the bank is more exposed to the risk of non-performing loans and recessions.

To prevent banks from risking too much of their customers’ money, most countries have laws on the maximum leverage of banking institutions. Especially after the sub-prime mortgage crisis in 2008, these limits were tightened, in order to prevent a new crisis due to non-performing loans.

Financial leverage: Opinions and Reviews

Leverage is a very popular tool today, thanks to the huge expansion of CFD brokers within the retail investment market. However, the fact that it is so widely available should not necessarily be an invitation to use it in every case and under all circumstances.

Therefore, we are going to list our opinions and reviews on leverage, matured during years of trading and after more than 10 years as financial popularizers, in order to go beyond the purely academic approach and enter the real case scenario.

Is it worth using it? ADVANTAGES and DISADVANTAGES

In the world of investments, we can never speak correctly about tools and products that are convenient for everyone and we cannot do so even with leverage, an instrument that has its own particularities and that surely, due to its very way of working, is not suitable for everyone.

By analyzing the pros and cons of this instrument, we will be able to realize in a more transparent and intelligent way what the advantages may be for our trading style, for our risk profile and more generally for our investment strategies.

FINANCIAL LEVERAGE – ADVANTAGES

- Increased volatility of the underlying asset

This is a pro, if you will, relative only to those who need markets and assets that move quickly enough to allow short and very short term investments. Maximum leverage can certainly move markets that would otherwise be almost immobile and open up greater opportunities for scalping or intraday trading.

Take the Forex market as an example. Currencies barely move every day, with changes in the order of just a few pips on some occasions. Even with a very good strategy, it would be hard to profit more than 3-4% a year on a solid trade. By multiplying this percentage with leverage, however, also the Forex market can be traded profitably.

- Hedging of inverse correlation positions

Hedging the risk of other positions is very useful when exposing yourself to volatile markets. For example, if you have invested in the electric car market, you could lose money if the price of lithium rises so much that these cars become unattractive. In order to hedge yourself, you could invest, using leverage, in the major companies that sell lithium and would benefit from high prices. This advantage in hedging remains – at least for our editorial staff – one of the most attractive features of leverage and margin investing.

- Multiply earnings

The good side of the leverage coin: obviously, when you have a winning position, when you have guessed a strategy, leverage works directly as an earnings multiplier. As we will see in a moment, there is also another side of the coin that we must necessarily consider when approaching this type of instrument.

This also applies to other streams of income derived from trading securities, not just the capital gain. If we purchase more stocks or more bonds by applying leverage, we also get more dividends or interests

FINANCIAL LEVERAGE – DISADVANTAGES

Obviously, the disadvantages of this tool must also be considered, which sometimes make leverage unprofitable for those who want to invest.

- Costs

The increase in leverage increases the costs that are linked to any type of trading operation. This is because the spread and overnight commissions are calculated on the entire position, including the leverage multiplier and not just on the actual capital employed.

Although the best brokers operate with overnight commissions and spreads that are very low, the fact remains that we are faced with a real problem that must be calculated before opening positions. The most advanced brokers allow you to calculate, at the opening of the position itself, the value of those commissions.

- Increased risk

This is the other side of the coin of increasing eventual profits. When we use leverage, it operates as a multiplier not only on profitable positions but also on positions that have made losses.

If leverage is then applied to positions that are already risky – on assets that are already particularly volatile – the risk very often exceeds the threshold of tolerability even for those who have a very strong propensity for leverage.

Our opinion on the use of financial leverage

Financial leverage is a useful and powerful tool that can always be considered for setting an order within a complex strategy.

However, we must be careful to consider leverage as a valid solution for any type of portfolio and investment strategy.

Financial leverage must always be handled with extreme care, taking into account what may be the risks related to exposures that are amplified through this precise instrument. We must also discard, at least in our opinion, the opinions of those who urge us to always invest with the maximum leverage allowed.

We would like to reiterate, at the end of our opinions, that leverage must be considered for what it is: a very powerful tool that therefore must be handled with extreme care, precisely because in the world of finance, great possibilities always correspond unequivocally to equally important risks.

The same opinion seems to be shared by most of financial authorities around the world; we have seen many of them imposing limits on the amount of leverage that investors can use, but none of them has banned it completely. Just as any other financial tool, it should be used in the appropriate occasions and “black or white” opinions should be avoided.

Financial leverage in business economics

In business economics, leverage is the ratio of debt to equity of a company.

A higher ratio corresponds to a higher level of risk that the company may not be able to repay its debts and therefore go bankrupt. This is not the only tool for assessing the actual health of a company, but very often when the leverage of a company is very high, bankruptcy is just around the corner.

According to the prevailing doctrine in business economics, a leverage ratio for companies between 1 and 2 would be the correct one. If the ratio is higher than 2, the company is considered undercapitalized.

The most widely used formula for calculating this specific magnitude is as follows:

- (Equity + debt capital) / debt capital

If a company had equity of 20 million Euros and a debt capital of 10 million Euros, the leverage ratio would be 30/20, or 1.5, indicating a good state of health of the company.

Keep in mind that every company should be analyzed differently depending on the sector in which it operates and the stage of the company life cycle. Startups tend to have higher debt-to-assets ratios, while established company are usually less in debt.

Financial Leverage risks

We have already mentioned in several sections of this guide the risks that are inherent in leverage and its application. The principle should be clear by now to those who have followed the guide up to this point, and we will go on to set out some operational concepts before moving on to the final conclusions.

- Leverage acts as a multiplier in every case

Leverage acts as a direct multiplier of the performance of a particular security in case of profits and losses. This means that when the underlying asset that we follow with our investment should report a -3%, with a leverage of 1:10 we would record in the portfolio a dry -30% in relation to the capital that we have actually committed.

You should factor the average volatility of a financial asset when you choose the amount of leverage that you want to use on your positions.

- The risk of miscalculation

Operating with leverage requires us to calculate the possible evolutions of our investment. Mistakes, especially for beginners, are frequent and can cause unpleasant surprises.

Leverage certainly increases the complexity of the prior calculation of the possible results of our investment, which remains for us a component of risk. Experience in this sense can offer a hand: learning to use leverage with a free demo account like this one which allows you to gain experience without the risk of losing real capital.

- The risk of commissions

Commissions must always be associated with inevitable losses when trading. Let’s imagine having a portfolio which after 1 year has totalled 0%, i.e. a portfolio which has recovered the losses it has recorded in the first part of the year.

In this case, we would be almost at breakeven if we had not used any kind of leverage. With leverage instead, especially on positions held for a long time, we will have a loss equal to the rate charged by our broker on the capital we have borrowed. This is equivalent, albeit indirectly, to greater risks that can be considered as part of the leverage and that must be, at least in our opinion, definitely calculated.

Final Considerations

Leverage is a very useful tool and part of the goodness of the offer from CFD brokers. However, like all investment tools, it should be known, evaluated and used only when needed.

Our opinion is that financial leverage is a very useful tool when used in the right way. We believe that it is important to know its mechanisms and learn to understand when and how to use them.

Often those who use very high levels of leverage are incurable optimists about their investments. It’s right to be optimistic, but keeping in mind that that being always profitable doesn’t succeed even for legends like Warren Buffett. Therefore we can only make up our readers from this insight and evaluate for themselves if and when to apply leverage to their investments.

FAQs about Investing with Leverage

What is leverage?

Leverage allows investors to borrow money from their broker, in order to open larger trades while also multiplying the effect of price changes.

Is leverage risky?

Yes. Leverage enhances risks for investors.

What can I trade using leverage?

Leverage can be used to trades Forex, stocks, commodities, ETFs, cryptos and related derivative contracts, such as CFDs and futures.

What are the costs of leverage?

Since leverage implies borrowing money from the broker, the trader owes interests that are charged everyday (usually at 11 pm) on the borrowed capital.

Do ETFs use leverage?

Some ETFs are leveraged, but most of them are not.

Guide

Short Selling

Short selling is a speculative strategy that focuses on the decrease of the value of financial security. An opposite strategy to the “classic” one, which instead involves betting on the rise in the value of a particular asset or security.

It is used to speculate on the price of a security that could be in trouble or in other cases – these are more relevant especially in articulated strategies – to hedge, that is to cover oneself from the risk of positions in inverse correlation.

With the arrival of CFD contracts contracts also on the retail investment market, short selling is available to everyone, even to very small investors and – although traditionally considered a tool for more experienced traders – it can be used within certain strategies.

Short selling – main features:

| 📈 Type: | Tool to profit from bear markes |

| 🎯Goal: | Speculating on downtrends, Hedging |

| 💰Commissions: | Spread, interests and/or fixed commissions |

| ⛔Risks: | They depend on the underlying asset – average to high |

| 🥇Best brokers: | eToro, Capital.com, Trade.com, Iq Option |

| ⚡Available with DMA: | Depends on legislation and brokers in your country |

What is short selling: definition

Short selling is the sale of securities that we do not have in our portfolio, in order to bet on their decline. A complex system, but today it is made much simpler due to the fact that it is offered by several brokers for online trading.

- Sale of securities that we do not have in our portfolio

When we decide to proceed with short selling, we are actually technically selling securities that we do not have in our portfolio. We are borrowing them in order to sell them now and buy them back in the future for a profit.

- Low-balling

Short selling exists because it allows you to bet on the decline of a specific security. If we think, for example, that soon gold will lose its value in the markets, we can open a short sale position to bet on the fall of the price.

Technically, with the short sale, we are selling gold today that we do not have, in order to reintegrate it with a future purchase. If the price of gold falls in the meantime, we will have made a profit. If the price of gold goes down, we make a profit; if it doesn’t, we make a loss.

- Margin investment

Short selling belongs to all those investment instruments on margin, i.e. investment instruments created to allow us to take a position on the markets by covering with actual capital only a part of the required capital. In this sense, it is the equivalent of leverage, with which many of our readers are already familiar.

- Leveraged investment

The possibility of short selling with leverage depends on the legislation in force in each country. In Europe, ESMA is the body responsible for regulating this aspect; in the United States it is the SEC, in the UK the FCA, and so on. The technique of short investment in combination with leverage is often used mainly for hedging purposes, i.e. to cover the risk of other positions.

- Using derivatives

Often the most convenient way to invest short in a certain financial instrument is through derivatives. Today you can comfortably choose between several brokers offering CFDs (contracts for difference) that offer this type of service. CFDs constantly follow the quote of the underlying instrument but have much lower commissions especially when it comes to short selling.

What is it all about?

In reality, behind short selling, there are complicated procedures, which it is good to be aware of in order to understand what happens every time we operate with short positions.

- We are borrowing a security

Actually, when we operate with a short sale we are borrowing the security in question. Let’s imagine that we want to bet on the decline in Apple stocks. When we open a short position we are borrowing the Apple stock itself from a third party. This first step is the least intuitive, but it will surely become clearer after we analyze the next steps of the short sale.

There is an exception to this rule, or at least there used to be. It is called “naked short selling” and it allows the trader to short an asset that he has not previously borrowed. This is now banned in most legislations, though there are still countries that allow it for big financial institutions.

- The security is sold immediately

The security or securities we have borrowed are sold immediately on the market and, even if we do not see it, the sum we have obtained is set aside by the broker. It will be used later to repurchase the securities to be returned to those who lent them to us.

- At the closing of the position we buy back the securities and return them

When we close our short-selling position, the broker will buy back at market prices the shares we borrowed and return them to the original owner. This is the final step that allows us to understand how short selling actually works at least in its original form.

If we have borrowed 10 Apple shares for a total of 2,000 USD (the value is an example) in price at the time we open our short position, two things can happen.

If the total price of the borrowed Apple shares will be higher than 2,000 USD we will have to spend more to buy the same number of shares and we will have recorded a loss. Let’s imagine that Apple’s share price is now 220 USD each. To buy 10 shares we will have to spend 2,200 USD and will therefore have lost 200 USD.

Alternatively, if the price has fallen, we can buy the same number of Apple shares at a lower cost and therefore make a profit. Let’s imagine that Apple shares are worth 180 USD each at the time of closing our short order. We will have earned a 200 USD profit because to buy the 10 shares to return, we will actually have spent 1800 USD.

This mechanism can be amplified if you levarage your traders. In the first example, if we shorted 2.000$ of Apple shares using a 2X leverage, we would be shorting 4.000$ worth of shares overall. This means that, giving the same increase in the stock price, we would have lost 400$. In the same way, in the second example we would have made a profit of 400$. It is important to remember this fact, given that most short positions are carried out on margin.

- CFDs make this process obsolete

The process we have just described is actually something that is outdated and not practically used anymore. CFD brokers offer a procedure, for this type of operations, which is much simpler and does not involve buying, borrowing and selling. This is convenient for the sake of simplicity, but also for the commissions involved: short-selling CFDs is way cheaper than doing so with actual shares or other underlying assets.

When you choose to invest short via a CFD, you are simply betting on the inverse performance of the security that we have chosen as the underlying. It is a contract between us and the broker in which each agrees to pay the other the difference between the current price of an instrument and the price at the time we decide to close the position. If the price has fallen we will gain, otherwise, we will lose out.

- Short selling in Forex

In Forex short selling and related positions are much more common. The process is exactly the same, which is what we described at the beginning. When we go short EUR/USD, we are betting on the rise of the USD against the Euro. In the world of Forex, short selling is absolutely structural. To make it clear, opening a short position on EUR/USD is identical to opening a long position on USD/EUR. They are simply two ways of looking at the same operation.

How to sell short: some practical examples

Step by step we are going to analyze how to place short sale orders using four different online trading brokers and four different stocks and markets. The operation, which on paper may seem very complex, in fact, it’s relatively simple and still mirrors, even in difficulty, the classic orders of long positions.

- Short selling Amazon shares with eToro

Thinking that Amazon shares can grow forever is not plausible and in any case, the idea that sooner or later they will surely have to return to lower price levels is starting to circulate, at least among some specialists. Let’s see together how you can sell short, without paying commissions of any kind, using eToro.

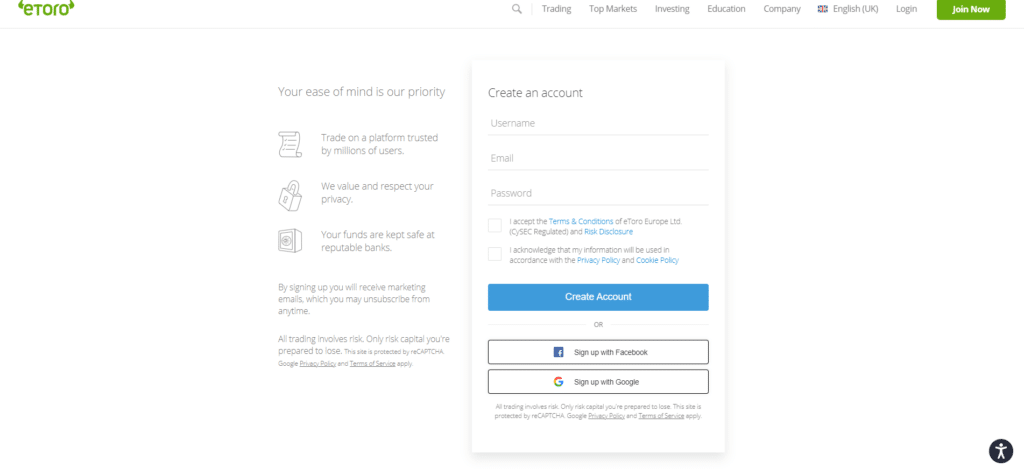

STEP ONE: In order to place a short sale test order on Amazon stocks we will need to open a demo account with eToro. You just need to choose a username, an email and a password. Then you will receive an email with a link. Click on the link to confirm your email account and you will immediately be granted access to the platform.

STEP TWO:We will now need to find Amazon shares within the eToro Investment Dashboard. Simply search for “Amazon” in the search bar at the top. After that, by clicking on the blue “Trade” button we will be able to choose all the details of our investment.

STEP THREE: Let’s choose all the details of our investment, such as the amount of money we want to invest and any leverage. Remember to choose “SELL” at the top, so we can invest in a short position. After completing the selection of details, click on “Open Trade” to open your investment.

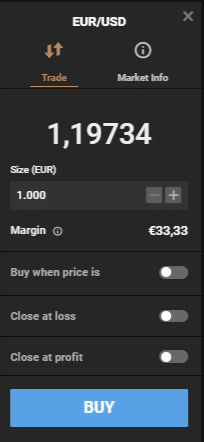

- Sell EUR/USD short with Capital.com

EUR/USD is the most liquid of the Forex pairs and by taking a short position we will have the opportunity to bet on the rise of the second component of the pair, that is in this case the US dollar. We will place this test order with Capital.com.

STEP ONE: Again, we will have to open a demo account with Capital.com. It is one of the easiest and fastest to open: we will just have to enter an email address and a password to access the platform. Once these details are entered we will have immediate access to the platform, but keep in mind that you will have to verify your identity to trade with real money.

STEP TWO: From the Capital.com platform we will have to find EUR/USD. We can find it by scrolling down the menu, getting to FOREX and then choosing USD. On the list that shows up, as you can see in the image, it is possible to find EUR/USD. Otherwise, you can use the search bar as we did before on eToro. Now let’s click on the correct pair and choose SELL.

STEP THREE:We will now have to place the order. We will set the amount of money to invest, and we can also activate take profit, stop loss or order at a different price than the current one. When all the details are correct, just click SELL to open our short-sell position on EUR/USD.

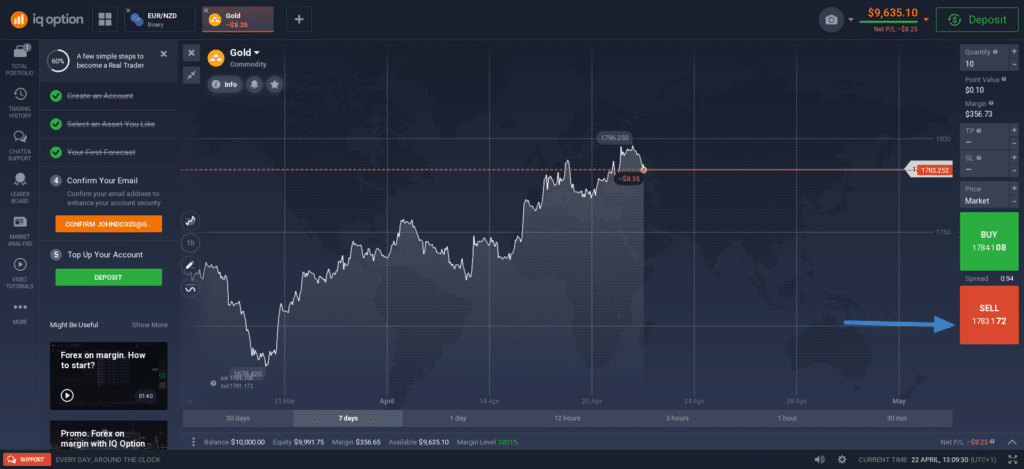

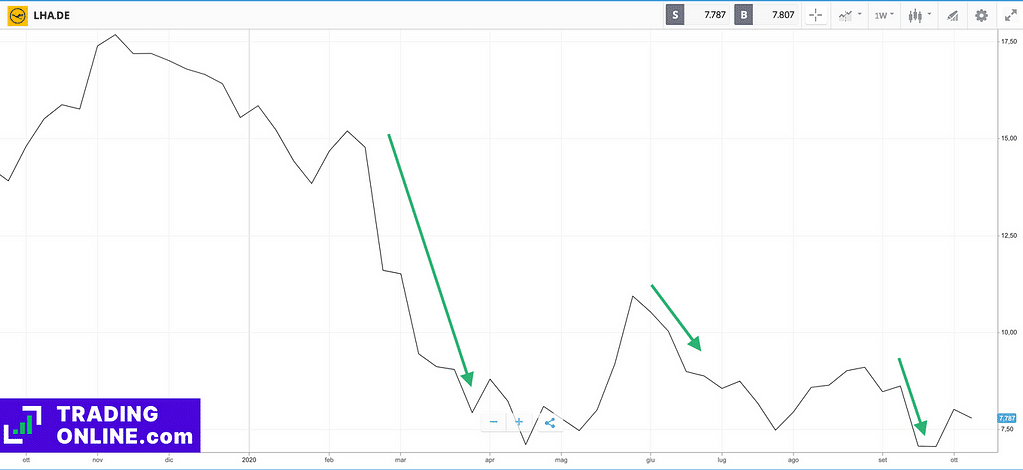

- Selling Gold Short with Iq Option

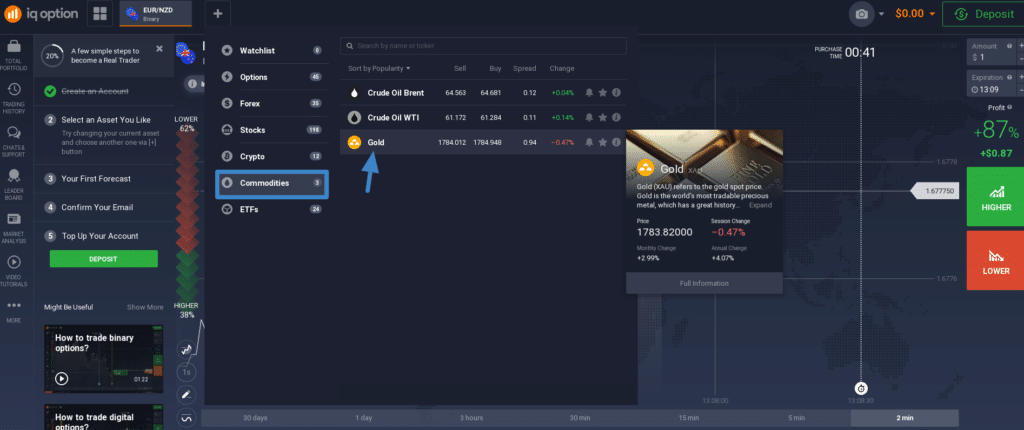

Gold has a strongly anti-cycle trend and can also have long recessionary periods at the price level, which opens important opportunities to trade short both for profiting and for hedging purposes. We will do so, in our test order, with IQ Option. This broker, which is available almost all over the world, is famous for having a very low minimum deposit (just €/£/$10).

STEP ONE: Let’s open a free demo account with IQ Option – an account that allows us to have access to virtual capital to test the platform’s functionality and also our trading strategies. Once on the registration page, click on OPEN AN ACCOUNT FOR FREE, enter a valid email address and password. Then click on REGISTER. We will be automatically directed to the IQ Option web platform.

STEP TWO: Now we will have to get to the Gold chart, from which we will place our order. Let’s click on “+” at the top, then go to “Commodities” and then “Gold“. Let’s click on it to access the chart that you will see on a screenshot right after this paragraph. On the right side, we will be able to place the order details.

STEP THREE: Here we can set the amount of money to invest, the leverage to apply and other details. When the details of our order are correct, we can execute the short sale by clicking SELL. In the “Portfolio” section you will be able to monitor all your open orders and close them whenever you want.

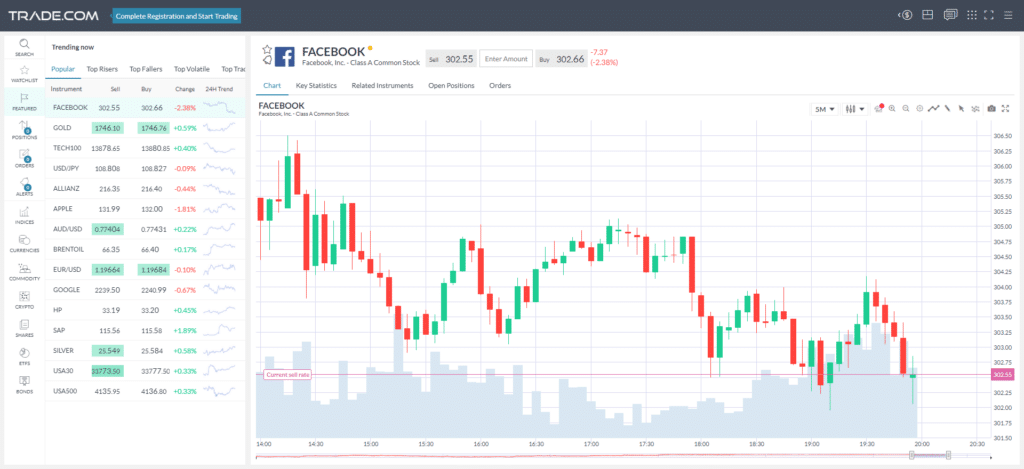

- Sell DAX 30 short with Trade.com

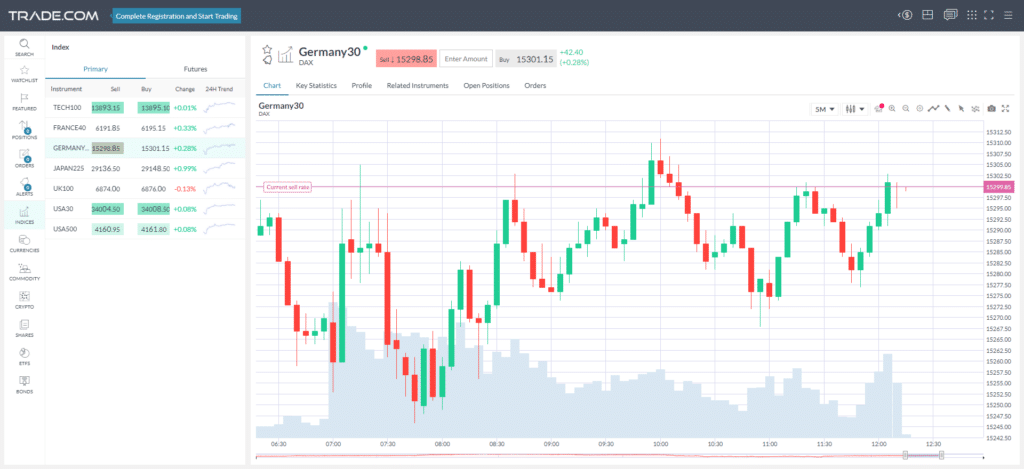

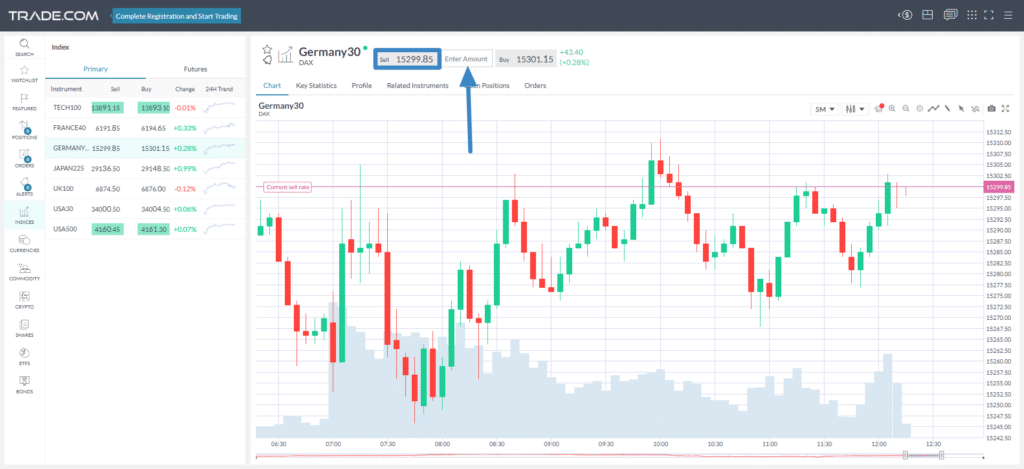

DAX30 is the index that allows you to invest in the 30 best stocks that are listed on the Frankfurt Stock Exchange, in Germany. To sell this stock short, we will proceed with Trade.com, a multi-asset broker that has always offered the possibility to operate also with leverage.

STEP ONE: open a demo account with Trade.com. Enter your First Name, Last Name, Email and Phone number to switch to the free demo account with virtual capital. Once we have entered these details, we can switch to the platform by clicking on “Create Account”.

STEP TWO: We have already been redirected to the trading platform of the broker Trade.com. We will now need to access the DAX chart, available from the “Indices “ menu on the left. We then click on “Germany 30”, with which the broker signals the DAX 30 and we will find ourselves in the chart that we attach to our guide right after this paragraph.

STEP THREE: let’s place the short sale order by clicking on SELL and completing the details of our investment. Also here we will be able to set take profit, stop loss, as well as other types of details such as the order triggered at a certain price level. We click on INSERT ORDER and we will have placed our first short sale order on Trade.com and DAX30.

Where to do short selling: best platforms

[broker]

After the table, let’s get to know more closely what are the features of the best brokers for short selling.

eToro is a mixed CFD and DMA broker that offers short selling on all securities in its offer, which is currently over 2,100. Like all CFD brokers, it applies a double commission, namely the spread and overnight commissions. When comparing these two costs with the market average, they appear to be very convenient.

eToro is a European broker with a regular license, which permits as we did just above to open a demo account at zero costs. In this way it also allows us to test our trading strategies with short selling using virtual money, thus running fewer risks. Definitely one of the best brokers overall, with a particular convenience when it comes to short selling. Not only for the tight spreads, but also because it allows you to manually select the leverage you want to use on your trade, giving you more control on your investments.

For those who want to combine this type of operation with more classic trading, it is worth mentioning that eToro also offers zero commission shares, in DMA mode, on the same platform and with neutral access to all major markets around the world. At least for now, however, you cannot short real stocks using eToro.

Note for U.S. Traders: even if eToro is available in the United States, CFDs cannot be offered to american investors. Giving that eToro does not allow traders to short-sell real stocks, U.S. traders do not have the possibility to open short positions to this date.

Capital.com is a pure CFD broker, duly licensed by the European Union and with over 3,000 stocks on its lists today, all open to short selling.

Also in this case, as with the previous one we mentioned, we have a broker that offers this type of instrument with ease and at a very low cost, in order to have all the instrumentation that was once only available to professionals. We can also count on an A.I. powered by Capital.com that analyzes or trades to give us personal suggestions on how to become more profitable.

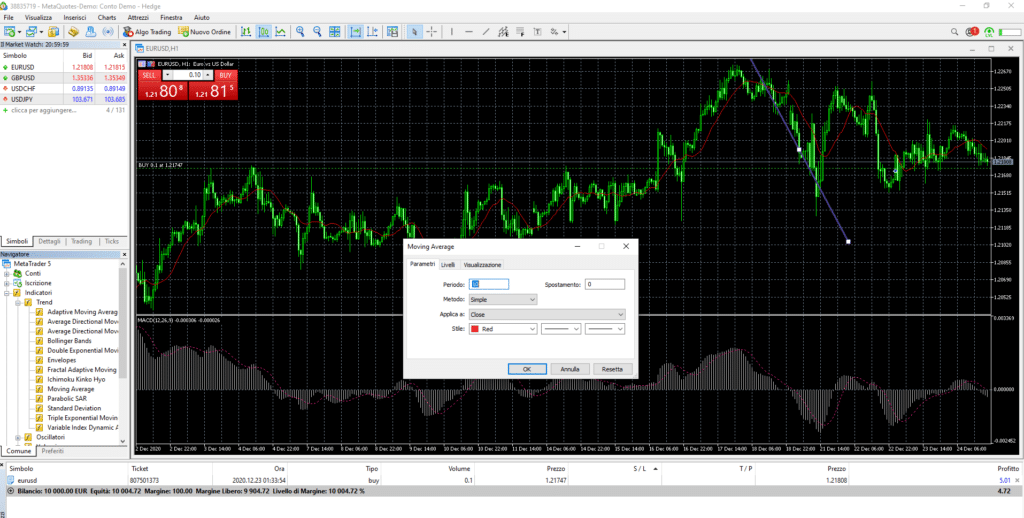

Capital.com provides its clients with three different platforms: the one it owns, developed by the broker itself, Metatrader 4 and TradingView. You can test Capital.com in demo mode (free and unlimited), with no costs included and without any kind of obligation to switch to a real account later.

Trade.com is a multi-asset broker that also offers a very rich CFD section, with over 2,300 securities to invest in. Trade.com’s free demo account offers access to its own proprietary web platform, which allows you to invest with virtual capital and at no additional cost.

With this broker, you can trade stocks from all over the world and many commodities, for the world of Forex currencies and also for indices and bonds, as well as cryptocurrencies. If you want to focus on futures, you have one of the most complete lists of tradeable futures that you can find on an online trading platform.

A complete broker that allows us to make all the experience we need without costs, and then eventually switch to the real account and also use MetaTrader, the best possible platform for online trading, at least according to specialists. If you choose to trade on Metatrader, the number of assets you can trade will be restricted; to compensate for that, you will be able to access exclusive features such as automatic trading signals and algo trading.

IQ Option owes a significant part of its popularity to the fact that it is the only broker in the world that offers real accounts with only 10 euros, pounds or U.S. dollars of investment. A particularly low sum, which allows everyone to have access to professional trading equipment.

It offers short selling on the selection of securities – small but of quality – that it makes available to its clients. It will not have the thousands of stocks we have seen with the other brokers mentioned, but it still offers great spreads on Forex, stocks, commodities and cryptocurrencies. Here you can open a demo account with IQ Option and start trading with 10,000 USD of virtual capital.

Depending on the country where you declare to reside, you may also be able to trade binary options on Iq Options. For example, French traders can not access this asset class as European laws do not allow brokers to offer binary options to retail traders. In most of Central and Latin America, as well as in some Asian countries, they are still completely legit and available on the platform.

The equivalent of a short sell using CFDs, when using binary options, is a PUT option. In this case, you will be rewarded if you successfully predict the downfall of a financial asset. Keep in mind that binary options are more speculative and potentially riskier than CFDs, so you should be even more careful.

Learn how to short sell

You can learn how to do short selling with books, video courses and trading courses: it is such a basic topic that it is covered by practically any kind of market guide, although not all of them can be considered as equally valid. For this reason with our editorial staff, we have decided to propose a guide that is able to explore the topic with concrete and factual information.

Top short selling books

Short selling is one technique of many that we can implement to manage our portfolio. Therefore it becomes very difficult to find books that deal exclusively with this topic. This is not so bad, because we can find specific insights on the subject in very interesting books about the world of trading.

- A Beginner’s Guide to Day Trading Online by Toni Turner

A simple book that covers all the basics of online trading, including short selling. The book is designed for novice traders who want to learn how to do speculative online trading, also taking advantage of investments on the downside of financial instruments. Since it was first published, it has been a best-seller. In 2007 a new edition came out, that is still today one of the 50 most read books about economics in the United States.

- How to make money selling stocks short by William J. O’Neil

A book entirely dedicated to short selling, how to use it in the best way in your investment strategies and its role in the financial markets. A manual of a more technical nature, which closely analyzes the characteristics of a stock on which you can successfully make a short sale investment. Balance sheet data, fundamental analysis and other topics requiring intermediate financial market expertise are mentioned.

- Short Selling for the long term by Joseph Parnes

An unconventional book that approaches the topic of short selling from a unique perspective. Many, including us, find this tool useful primarily for the short term. Parnes’ approach is contrary and it is absolutely recommended for those who want divergent, but intelligent, opinions on short selling. What we like most about this book is how it manages to focus on the bright side of short selling. It shows exactly how the markets overprice some assets, and how short-sellers can take advantage of them and make the markets more efficient at the same time..

Short selling video courses

Even free video courses can help us to understand the real magnitude of the world of short selling. We have selected three videos to further explore the topic. All videos use a different approach, but they are all very simple.

- How short selling works di The Plain Bagel

The Plain Bagel has one of the best informative channels on Youtube. It deals with the world of financial markets from every point of view, including the basics of short selling. In this short video explains the mechanisms we talked about in the guide, with the addition of some animations that make it very entertaining.

Before watching the video, we have to inform you about a controversial point that is discussed towards the end. The author claims that when an investor shorts an asset, he can virtually lose more than he invested. This is not the case anymore, at least in most countries, as brokers must legally protect traders against negative balance.

- How to short a stock di ClayTrader

In this video of about 20 minutes we get to the practical aspect. The author shows you how to invest short on AT&T stock, showing every practical step you need to follow to execute the trade. It’s the same steps we’ve seen in our examples, but with one difference: instead of using a CFD broker to avoid commissions, ClayTrader sells short actual shares. In Europe, in the UK and in Asia it is quite uncommon for retail traders to short sell un underlying asset.

In the USA, this is different. Although you cannot do naked short sells (short selling without actually borrowing the asset from someone), you can short sell actual stocks with reasonable commissions even without using derivative contracts.

- Why is short selling legal? by CNBC

This video was made by CNBC right after the whole world stopped talking about what happened with Gamestop stock. In case you missed it, some Reddit users cooperated to massively buy shares of Gamestop, a chain of stores dedicated to gaming, whose stock had been heavily shorted by some hedge funds. Reddit users managed to skyrocket the value of Gamestop’s shares, leading even the mainstream media to talk about short selling.

The video is very basic, as it is targeted at an audience of first-time investors. The cool thing about it is how the story of Gamestop shares is narrated in the background: being one of the weirdest moments in the recent history of financial markets, we really think that traders should know at least the basics of what has happened.

Short selling opinions and reviews [2021]

Short selling is a useful tool available today to traders and savers with non-speculative strategies. Here we have collected the trading opinions of our editorial staff, as well as those of third parties that we can consider reliable and that may offer insights for further exploration of the topic.

Is it worth trading short?

Short selling should be seen as an additional tool that we have today to trade online and to make a profit even in situations where the market falls.

We also share the opinion of those who say that short selling is a tool for experts, for traders who have already gained some experience and know-how to operate using advanced tools. A certain level of experience should also be required by those who invest in the opposite direction, i.e. betting on the rise of security.

Even if the markets remain in a bullish phase for longer than they do in a downward phase, even when investing on the upside of equities one must be aware of the risks.

To stay strictly on the convenience of short selling, brokers today offer low-cost CFDs, which has made short selling effectively accessible to everyone.

Moreover, the complex procedure we have described in the initial phase of this study is now automatically handled by the trading platforms: we do not have to worry at all about finding counter-parties, borrowing securities, etc. This also helps to make the tool convenient.

Short Selling: Pros and Cons

Short selling definitely has pros and cons that must be evaluated before using the tool and especially before you decide to integrate it into your strategies. We will analyze what we believe to be the advantages and disadvantages of this specific tool also in order to offer our readers a clear analysis of what happens when we operate with short selling.

Advantages of short selling

- Excellent system for hedging

The practice of hedging allows you to hedge against risks for investments that have an inverse correlation. The typical example is that of a short position on EUR/USD – and therefore short selling of US dollars – to protect oneself from the exchange rate risk of an investment in US stocks. We could give hundreds of other examples to illustrate the additional usefulness of short selling in this regard.

We believe that the use for hedging purposes is indeed one of the main and most useful – which can only be at least in our opinion the biggest advantage of using short selling.

- Earn money while the markets are falling

There are many examples of financial market crises. It is no longer even necessary to recall the subprime mortgage crisis in 2008/09. The crisis due to the COVID-19 pandemic has reminded everyone that there can be periods, even relatively long ones, during which markets fall.

Short selling allows you to have a useful tool to invest in the stock market even in these moments of turbulence while investing on the upside during a recession would result in easy losses. And this can only be a huge advantage offered by short selling.

Disadvantages of Short Selling

- A powerful tool

As much as freedom is always good, even for investors, mismanaging freedom can become a problem. Short selling today puts into everyone’s hands the ability to access complex positions that with leveraged trading can become very risky.

Some fail to manage this freedom and take the advantage of short selling to take unsustainable positions with a level of risk much higher than legal and reasonable. Like all tools that the world of online trading makes available, they must be used carefully.

- Borrowing Costs

As we mentioned, short selling involves a loan of securities or, in the case of CFD brokers, a loan for the money that keeps the position open. Interest is therefore charged to our account in the form of overnight fees. It is also true that due to the great competition between brokers these rates are very low.

In the world of CFDs, overnight commissions are always charged on positions. With short selling, however, the rates are lower than with long positions.

Short Selling: Recommended Forums

We would like to give a shout out to five forums that are an excellent starting point for discussions regarding short selling and trading. These are the forums that we think are the best because, in addition to in-depth discussions on these types of instruments, they offer many other useful discussions for those who want to trade in the right way.

Reddit has become a very relevant place for investors to share strategies and express their opinions. There are many sub-reddits where you can find comments and posts about short selling. The most prominent is r/investing, where you will find thousands of investors talking about short selling every day.

- Investing.com

Born as a website to access market data, it has become increasingly popular as a forum. There is plenty of room to meet other investors and talk about short selling on Investing.com. The most popular places to do so are under the price charts and inside the specific “forum” section.

- Moneyforums by Citywire

If you are looking for a very diverse forum, this one is for you. You will find threads about everything that involves money, from filing taxes to short selling. It is also a very popular choice among international users, making it easy to hear opinions from people located all over the world.

- Analystforum.com

Analyst Forum has a level of discussion above average. The target here is experienced traders who focus on short-term investing, which makes it a very good place to talk about short trades. You will almost certainly find interesting analysis and opportunities, which is why we really love this forum.

- MoneySavingExpert Forum

Another incredibly diverse forum, where users discuss everything from credit cards to speculative trades. We find it a good way to learn about personal finance in general, where short selling is discussed as part of the wider picture of the many ways you have to invest your money.

Our opinion on Short Selling

Our opinion is that supply and demand should not be limited: short selling is important for the markets and their proper functioning, and we are happy to have this tool available to small traders as well.

We believe that controversies about short selling and trading are pointless, especially when they come from authorities and governments that periodically block them, without any scientific grounds.

Those trading on the European stock exchanges, in particular, will also have noticed a block on short selling during the recent COVID19 crisis in the hope of keeping the prices of certain stocks artificially high. We are not alone in this struggle with regulator intervention in the event of a major crisis. There is a substantial body of scientific literature suggesting that the moral issue of short selling should be eliminated once and for all. Short selling is functional to the markets and enables them to establish a real and concrete price for each instrument.

We strongly oppose bans, even in the most heated moments of crisis, for the following reasons:

- Market Distortion Effect

Markets know how to do only one thing – their hive mind is able to price, very efficiently, any type of asset. Intervening by prohibiting short positions has distorting effects on this mechanism, reducing the efficiency of the markets with damaging effects on the entire financial system.

- The “positive” effects are extremely limited, while the negative effects are long term

The positive effects on stock prices, where they have occurred, have always been very short term. There are tons of data demonstrating that the price of shares in times of crisis tends to conform to what the market considers “right”.

- Slows down recovery

The short sale ban on a stock slows its recovery and lowers its trading volume. This is certainly not desirable.

So, are the authorities that intervene to protect companies listed on their markets wrong? In our opinion and in the opinion of the top echelon of financial researchers, yes. After all, “the road to hell“, as the old saying goes, “is always paved with good intentions“. The situation is different for the individual investor who wants to access this type of instrument via CFDs. In this case, the suitability must be evaluated on a personal level, taking into account various aspects concerning short selling:

- It is a more risky position

Because even during a crisis there are a lot of price rebounds, so you risk entering with a short position, being faced with a rebound, and losing almost all your capital. We are not talking about an easy way to earn money, but about a speculative investment like the classic stock purchase.

- It is generally a short-term position

It is almost useless, especially in the stock market, to bet with short selling for long-term investments. It is a fundamental rule of this instrument that we should never forget. Between the costs involved, the ability of stocks to incorporate inflation and long-term stock market trends, it is absolutely unreasonable to actually expect the price of a stock to go down forever.

Final considerations

Short selling is a tool that is often criticized but, at least according to our editorial staff, it should be respected both ethically and practically. We have investigated its possible uses, not only the speculative ones, and we have talked about how successfully it can be used.

This is to date the only one tool to offer profits when markets are falling and low-cost protection with hedging positions. The tool, which is now widely available also thanks to the arrival of CFDs in the market, can be a useful addition to the normal way investors operate.

Always keep in mind that there is technically no limit to the amount you can lose on a short trade, and that markets tend to rise over time so it’s harder to figure out when to short an asset. Beside these two factors, the is no actual reason for an investor to avoid this kind of operation. Short selling should be respected as a powerful way to make demand and supply for financial instruments meet at a fair price at any given moment.

What is short selling?

It is a trading tool that allows us to bet on the decline of any security.

What are the assets that I can short-sell?

You can practically short any asset, from Forex to stocks, through cryptos, commodities and even ETFs.

Is short selling risky?

Short selling is generally riskier than investing in the opposite direction, as there is no limit to the amount you can lose (an asset price could grow indefinitely) and because markets have the tendency to grow, not shrink, over long periods.

Which brokers offer short selling?

Almost all brokers that offer CFDs also have the option to short-sell these contracts, namely eToro, Trade.com, Capital.com, Fp Markets and Iq Option.

Is short selling difficult?

Nowadays shorting an asset is very easy. Most platforms only require you to click on “sell” instead of “buy” when you open your trade.

What can short selling be used for?

You can use it both for speculative trading and for hedging, i.e. hedging against the risk of other positions to protect you from certain market conditions.

How much capital is needed to invest with short selling?

You need the capital to invest on margin and hedge price changes. Some online trading brokers, such as IQ Option, allow you to start with as little as 1 euro per position and a 10 euro minimum deposit to open an account.

Guide

CFDs: what they are and how they work

CFDs (Contracts for Difference) are derivative financial contracts that replicate the performance of another asset and allow you to invest against a Market Maker broker without ever passing through the underlying asset itself.

They represent a complex and particular instrument, which has had (and in all likelihood will continue to have) enormous success in Europe and Asia – in the USA, however, it is banned from the retail market – because it allows leverage and, above all, access to different markets at the same conditions. Born as an instrument used mainly by hedge funds, today CFDs are a financial product accessible to all and that can be used even by those who operate for the very first time on the markets.

Main CFDs features:

| ❓Type of asset: | Derivative with no deadline |

| 🛠Allowed: | Leverage & short selling |

| 👍Broker: | Best Online Trading Platforms |

| 📈Markets: | Stocks, Forex, Commodities, ETFs, Indices, Bonds, Futures |

| 💷Fees: | Spread and Overnight fee |

| 💰Investment: | You can start with as little as 10/20$ |

| 💪Regolator: | ESMA (Europe), ASIC (Australia), FCA (UK), |

| ⛔Risks: | Subject to leverage |

What are CFDs

CFDs are derivative contracts that allow you to invest on margin, replicating the price trend of an underlying asset. They are derivative contracts and are typically traded outside official exchanges, therefore in OTC (Over The Counter) mode.

This is the “scholastic” and traditional definition, but for those who are not already experts in financial markets, it is quite difficult to understand. That’s why we want to start with the basics and see all their features in a simpler and more intuitive way.

CFDs are:

- Derivative contracts

Like Futures and Options, contracts for difference are also derivative contracts. In fact, they do not involve the purchase or sale of the underlying asset, but simply of a security that replicates, with certain mechanisms, its value.

When we buy a CFD on Apple shares we are not actually buying Apple shares, but a contract between us and the broker, which follows the trend of the stock. In reality the mechanism is much more complex, at least behind the scenes, but we will get to that with the analysis of the other peculiarities of this contract.

- Suited for margin investing

CFDs are margin investing instruments. When we open a CFD position on Amazon shares for 1,000 USD, we do not have to pay the full amount, but only the margin to cover it. If we choose to trade without a margin, the coverage will necessarily have to be 1,000 USD. by choosing a margin of 50% – i.e. a 1:2 leverage – we will be able to cover the entire investment with 500 USD. If we choose 1:5 leverage – which is the maximum allowed in Europe, for example – we will only need to cover 20% of the position, in this case 200 USD.

Different jurisdictions have different rules on leverage. While in the United States it is not allowed to trade leveraged CFDs, in Europe it is possible to invest in stocks with a leverage of up to 1:5. In Australia, on the other hand, as well as in other countries it is possible to reach a leverage of 1:50 on stocks and even 1:200 on Forex.

At TradingOnline.com we have selected and reviewed all the best brokers that allow their clients to trade through CFDs:

- eToro (here for the official site)

- FP Markets (here for the official website)

- Capital.com (here for the official site)

- Trade.com (here for the official site)

Being able to trade with leverage makes CFDs attractive to investors who do not want to lock up all the liquidity they need to conduct their trades. The margin however, as we will understand more clearly later on, is also a risk multiplier, because each movement of the security will multiply by the leverage we have applied, both positive and negative.

- Replicate the price of the underlying asset

Throughout its lifetime, that is, until we decide to close the position, the CFD will follow the trend of the asset we want to, albeit indirectly, invest in. When we choose a CFD on Ethereum (yes, cryptocurrencies can also be hedged with CFDs), we get a price at the opening of the position, let’s imagine 350USD.

As the real value of Ethereum moves, the value “carried” by the contract also changes. For the performance of our capital, net of margin, holding a CFD or holding the underlying asset is virtually identical.

Minor differences can occur when the supply and demand for a certain financial instrument are very different between the exchange where the instrument is listed and the broker you are using to trade CFDs. Especially in very “hot” moments, such as after the Brexit referendum, it is difficult for a CFD to replicate the exact value of the underlying instrument moment by moment. The difference remains small in any case.

- Traded in OTC mode

CFDs are typically Over the Counter instruments and they are not traded on regulated exchanges. OTC products are products that are not traded on a public exchange, but typically between the dealing desk (i.e. the broker) and the client. This means that the contract, being a derivative instrument, is between us who invest and the broker who has made the contract available to us.

Some states have tried to offer regulated markets to trade CFDs on the secondary market as well, imposing draconian regulations with the aim of making the market more transparent. However, very few have moved to this type of channel, mainly due to the obvious increase in transaction costs associated with such a solution.

The OTC mode can be a problem because it presupposes on the part of the investor full and total trust in the broker who also acts as a dealing desk. The CFD contract is literally a contract between two parties and there is no intermediary, state or otherwise, to standardize such contracts and above all to verify the solvency at any time of the contract in place.

A broker might sell you the CFD on a certain financial instrument, but no longer have the money to buy it when you decide to sell it. That’s why there are financial authorities, such as ESMA in the European Union, FCA in the UK and ASIC in Australia that oversee brokers. Their job is to make sure brokers remain solvent at all times and that they have insurance that covers their risk of insolvency.

However, we will be able to discuss this issue in greater detail when we look at the risks involved in this type of investment.

CFD definition

“CFDs” stands for Contract for Difference. The definition, however, aims to clarify only one of the fundamental aspects of this type of contract, namely that they are contracts that operate primarily on the difference in price between the current value of the underlying (the spot price) and the value at the time of closing the contract.

The most ignored part of the definition of CFD is the one related to the contract: we are in fact in front of a negotiation between two parties, that is between the broker and us. This contract is only between us and our broker: unlike real stocks, we cannot buy a CFD from a broker and then sell it to another person or another broker.

This feature of CFDs opens up several questions:

- They are not all exactly standard

As we mentioned, very small differences can occur between the market price and the CFD price. Although most jurisdictions have regulations on this aspect, it is possible that two different brokers, at the same time, have two slightly different prices for the same CFD.

- The broker is our counter-party

And this is what the detractors of Contracts for Difference focus on the most. Because on the one hand the broker is technically betting against us and because on the other hand he has to be the one to honor the contract we have opened. We are not in the sea of actual financial securities, where the security is worth owning and can be sold to third parties. CFDs only have value between us and the broker who issued them. They are precisely a contract between two parties.

How CFDs Work

After having analyzed the didactic and scholastic parts of these contracts, we are ready to understand how the instrument in question works, especially in everyday practice on the financial markets.

Why can CFDs be a good alternative to what is offered by the direct purchase of securities? Because they present particular characteristics that offer operativeness and tools that classic trading without derivatives and underlyings cannot offer.

- Investing on margin

It is very important, since the first appearance of this type of contracts. It should be remembered that CFDs have been widely used, especially by hedge funds, because they allowed them to cover important positions with a minimum capital commitment.

Leverage is as powerful as it is risky, because it allows you to technically invest capital that you do not have. The price difference on the leveraged investment, however, is directly reflected in the capital we have actually invested.

So if we invest 100€ on EURUSD, with 1:30 leverage, we will be exposed to the market for 3,000€. A variation of 3% in the value of the pair would mean a variation on our capital of 3% of 3.000€, or 90€. That would be 90% of the capital we have invested.

This can be very advantageous if the position we have opened is correct. We will almost double our investment with one trade and within a few hours. However, it is worth remembering that this multiplication is valid both ways, i.e. even if our position should be negative. Following the example above, we would have lost 90%.

- Short positions

CFDs also allow you to short-sell. All CFD brokers also offer this possibility, which allows you to bet on the decline of the underlying asset. Do we believe that Tesla shares will have a drop in the next few days? Well, we can buy a sell or short contract from a CFD broker and then close the position when the stock has lost enough value.

This possibility is impossible to achieve if not through the use of derivative contracts, of which CFDs are the most important representatives at least for those who access the markets on their own.

- Liquidity

When talking about the functioning of CFDs we must also talk about liquidity. Let’s talk about the market liquidity, that is the possibility of finding a useful counterpart for our purchase and sale. When markets are not very liquid, i.e. not very frequented by sellers and buyers, it becomes complicated to operate on the spot, i.e. with the certainty that at any time we can get rid of the position we have opened.

With CFD contracts instead, this problem is solved upstream: our counterpart will always be the broker who sold us the contract. The OTC system presents risks because the failure of the broker would result in the futility of the contract.

However, in almost every country in the world, the financial authorities have set very clear rules against this type of eventuality. For example, the fact that client deposits must be kept in separate current accounts from company deposits. Brokers must also show their financial statements to the regulator on a regular basis to show that they have sufficient liquidity to operate. Finally, most jurisdictions provide for mandatory insurance. The risks are therefore minimal in terms of liquidity, with absolute advantages for those who choose this type of product.

- What happens when we buy a CFD

There is actually a lot going on behind the scenes when we buy a CFD, although from the investor’s side the process is one of the simplest you can imagine, as it does not vary, except in small ways, from what happens with the direct purchase of securities.