TradingOnline.com

®TradingOnline.com is a financial website that promotes educational content. First published in 1999, it is now back with a completely renewed user experience and a lot of brand new content. Our mission here at ®TradingOnline.com is to promote educational and truly informative content, designed for everyone who is willing to learn online trading in a profitable and secure way.

What is online trading and how does it work, anyway? Let’s clarify its meaning and its most important aspects.

What is Online Trading: let’s clarify the meaning

Online trading is the activity that allows people to buy and sell financial assets on the internet, using electronic devices such as a PC, smartphone or tablet. The aim of this activity is, of course, to make a profit. We can otherwise define online trading as the activity that allows people to “invest on stock exchanges through the Web“.

Main features of online trading:

| First appeared in: | 1999 |

| Regulating institution: | ESMA (EU), FCA (UK), ASIC (AU), SEC (USA) |

| 💰 Initial cost: | Can be started for free |

| 📖 Educational content: | eBooks📚 / Courses📺 / Detailed guides📖 |

| 🔍Analysis tools: | 📊Indicators and Charts / News / Research |

| ❓How to trade online: | CFD Trading / DMA Trading |

| 🏦Where to trade online: | Best trading platforms |

| 🥇#1 Best Platform: | eToro ▶ Try it for free |

Now we can go into further detail, showing exactly how it works. Online trading is a highly speculative activity, aimed to people who are willing to invest today in a handy and rapid way. Surfing TradingOnline.com you will find everything needed to start.

How Online Trading works

Let’s make immediately clear what does it mean to trade online. The investor, known as a “trader“, needs to subscribe to an online broker that has received proper authorization in the country where the trader resides. This can be done using any electronic device with an internet connection. After the investor has signed up to an online broker, he will be able to send market orders using the trading platform provided by his broker.

This is exactly how to start trading online in a safe and professional way. Through online trading, each and every person can invest in financial assets while keeping commissions and bureaucracy at a bare minimum.

Thanks to the modern features of trading platforms, you can invest online on:

- Forex

- CFD

- Commodities & Metals

- Futures

- Stocks

- Index

- ETFs

a lot more easily. Be careful: we are not stating that it’s easy to be a successful trader, but it is actually easy to access the markets.

Where to Trade Online

You can trade online from anywhere in the world. You can invest on any stock exchange in the world, thanks to purposely designed software (online trading platforms, available for both desktop and mobile trading) and solid brokers.

As we said earlier, the very first task you need to accomplish is opening your account on a convenient and safe online broker.

Our team is always searching and trying out new trading platforms, so that we can suggest the best ones here on TradingOnline.com. To keep your money safe, make sure that you trade using an authorized broker.

[broker]

Important note: We want you to know that these brokers and their respective platforms are used by our own team as well, as we strongly believe that they are the most suited to satisfy a trader’s needs.

- DETAILS ON OUR TESTS AND CHOICES

We have taken into account several factors to choose the most reliable trading platforms:

- Detailed research about the company – history, legal details, regulating institutions and registered office(s);

- Educational material available for customers;

- Stress test on trading platforms to check their ability to cope with different trading strategies;

- Deep research on distinctive elements, if any;

- Stress test on the respective mobile trading app

- Proper withdrawal and deposit functioning

- Reviews and other kinds of feedbacks available online, and eventual legal procedures against the company

- Customer service stress test, using both the live chat and tickets

We ended up testing 143 different brokers and 157 different trading platforms, then we ranked all of them. In the end we chose the following brokers, which are also mentioned on other pages:

For these reasons, anytime you will find a mention to one of these brokers you will know why we’re not suggesting another one instead.

Choosing proper trading platforms is a key step to start trading online safely. We have more than 15+ years of experience in this sector and we can tell you with absolute certainty that we’ve never seen as many scams as we are seeing now. So we advise you to only choose reliable and safe online brokers, chosen by a team of professionals.

Safe Online Trading

Here at TradingOnline.com, we teach you how to stay safe while trading online. We guide you so that you can learn how to choose the sources of information and education: unfortunately, this market is full of scammers willing to make you lose all your savings.

Our mission is very clear:

We would like you to be able to tell by yourself who is telling you the truth and who is lying to you, avoiding false expectations.

If you are a beginner, we can almost be sure that at least once you have been exposed to ILLEGAL advertising of companies promising huge profits from online trading. This is all, completely, false. Reading through the content of our website, you will soon understand why.

We suggest you to only check reliable and official websites regarding online trading. For the same reason, we advise you to check the detailed guides that you can find on ®TradingOnline.com.

How to Trade Online

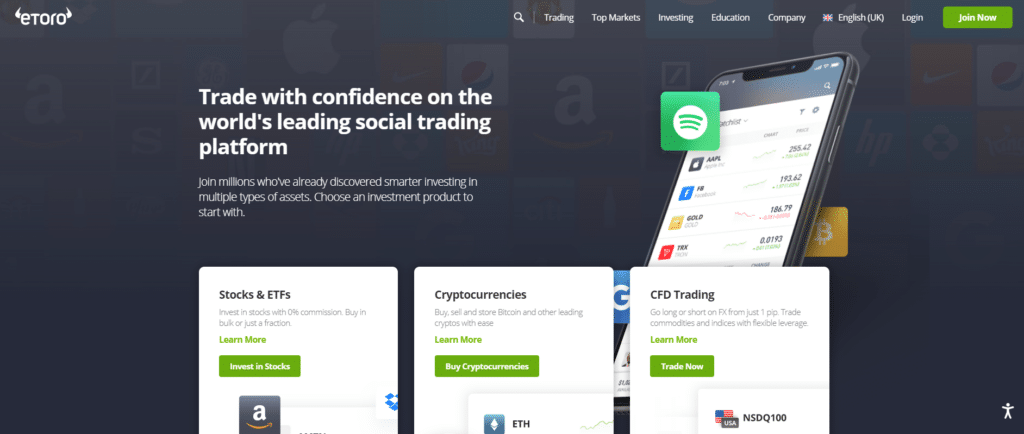

It is time to move to the most interesting section of our introductory guide to online trading. The following steps will help you learn how to trade online, starting from one of the brokers used by our team itself (we will use eToro in this example).

- 1° STEP – Sign up for a trading account

If you are willing to trade online, the very first step is to open up your account with a safe and authorized broker. We have chosen to use eToro for our example, as it is available everywhere around the world, it is safe and it offers unique functionalities that make it well suited for beginners. If you want to sign up now, visit the broker’s official website.

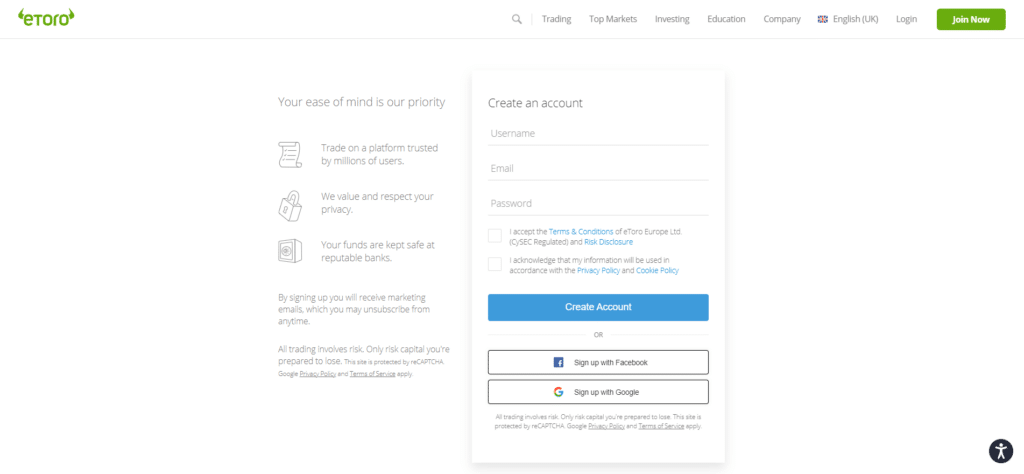

Now click the “Join Now” button. You will reach a new page, with a form that you have to fill choosing a username, email address and password. You will need these credentials to log in again, so make sure to keep them safe. Then click on “Create account“.

PLEASE NOTE: You can also register your account on eToro for free here.

Well done, you have received your free trading account!

Now you have two options:

- Using virtual money;

- Using real money.

In the first scenario you will trade using virtual US Dollars, so you will practice to better understand how real-money trading works. If you go straight to real money, you must verify your account first. Just click on “Complete your profile” and follow the steps. After your profile has been verified, you will be able to fund your account: the minimum deposit on eToro is just 200 $/£/€.

- 2° STEP – Opening a new position

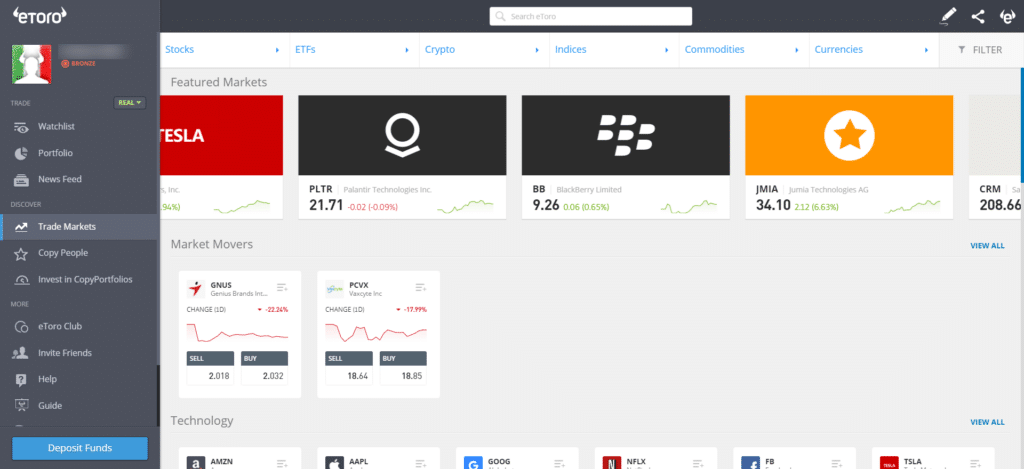

It’s time to make our very first trade! How can we do it? Well, inside your dashboard look for the “Trade Markets” section.

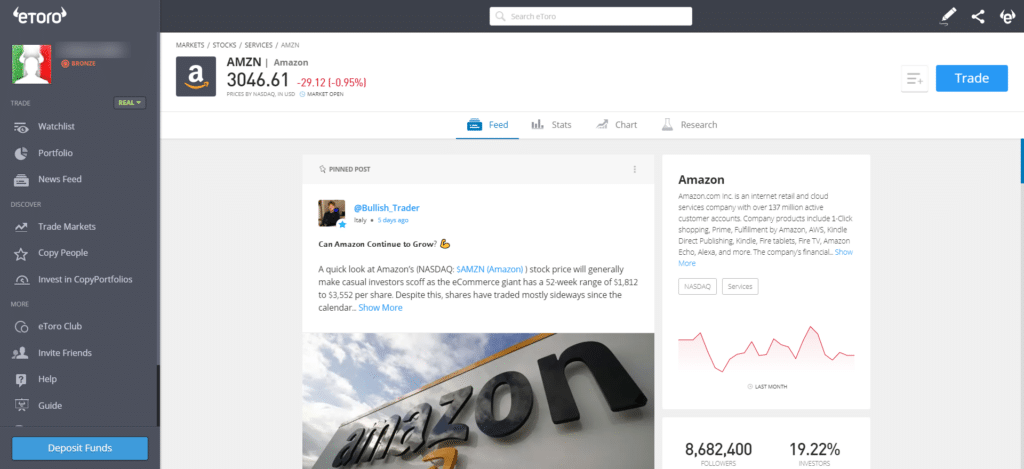

In front of you, you will see the complete list of financial assets tradeable on eToro. You can get inspired by any of the assets you see, or you can just choose the one you want from the search bar above. If you want to trade Amazon stocks, for example, you might just search for “Amazon” inside the “Search eToro” box. You will now see a page with all kinds of relevant information:

- Posts from the eToro community

- Relevant data on the company, such as its financials

- Price chart

- News and company overview

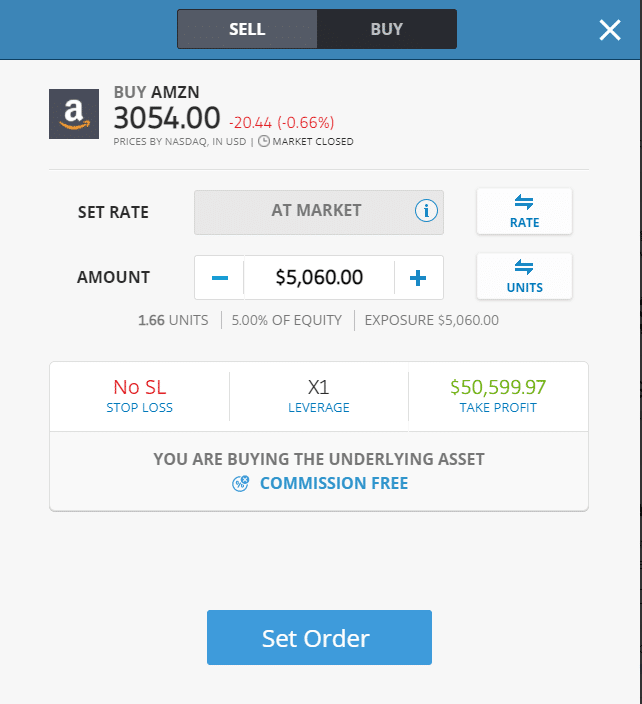

- 3° STEP – Setting the order

Let’s make this first trade! Click un “Trade” in the upper-right corner.

As you can see, a pop-up screen will appear asking you to set some parameters before you can set your order:

- Sell/Buy – You can choose if you want to buy or short the asset;

- Amount – How much you would like to invest;

- Financial Leverage – You can choose different leverages for your investment depending on the jurisdiction you find yourself in;

- Stop Loss – we advise you to set this parameter in order to limit the amount you can lose in the operation. To play it safe, it’s better not to exceed 10% of your invested amount;

- Take Profit – the price at which the platform will automatically close your profitable trade. You can go up to 50%, but you really should think twice before moving it over this percentage.

In our example, we have set an order valued at 5.060$. We chose not to apply any leverage, so we will invest exactly this amount. If we chose a 2X leverage, we would have invested twice as much: only 5.060$, our selected amount, would come from our bankroll, while the rest would be borrowed from the broker.

Important note: You can close your position manually whenever you want, even if the price has not reached your take profit or stop loss yet. If you think it’s time to close it, just go ahead.

How to practice Online Trading

We have just demonstrated how you can begin your online trading journey, from the moment you open a trading account until the moment you close your first trade. Opening a paper trading account with a reputable brokerage firm such as:

is the first requisite to begin trading like a pro. We suggest studying the subject before investing serious amounts of money. Important aspects of online trading are:

- Technical Analysis

- Fundamental Analysis

- Paper trading

You are lucky to start today. We have been beginners ourselves, of course, but in the early 2000s. Back then there weren’t nearly as many books, courses and websites about online trading as there are today. It was also way harder to find relevant feedback about what could already be found, making it difficult to tell if any piece of content was actually valuable.

Searching TradingOnline.com you will find many guides that can help you with getting things started. We hope that you will enjoy reading our content as much as we enjoyed creating it.

Why should you Trade Online? Pros and Cons

Everything we teach on TradingOnline.com is meant to give you an hedge while trading online, since your very first move on the markets. In the previous paragraph we showed you the steps to follow to begin trading online, but should you really try? It’s time to answer this question, showing pros and cons of this activity.

👍PROs of Trading Online

Online trading is a very valuable activity if done correctly, but you will need all the right tools. The same tools that pro traders use every day and that were exclusive to high-end hedge funds before the online trading revolution.

We are about to tell you, plain and simple, what are the pros and cons of online trading.

Accessibility

Through online brokers and online trading platforms, anyone can easily trade on any stock exchange in the world;

No account fees

Online brokers don’t usually charge you for opening, maintaining and closing your trading account;

Paper Trading

They are free, easy-to-open and very helpful. You should think of your demo account as the ultimate learning tool;

Low or zero fees

Online brokers usually charge you a little spread between the bid and ask price of an asset. Best-in-class brokers like eToro do not charge a fixed amount for every operation as others do, and they allow you to trade stocks with no fees;

Analytics

You can access a lot of helpful data and news directly from your trading platform, so you never miss out on the important events happening in the world of finance. The economic calendar is a good example;

Risk Management

Thanks to trailing stops, take profit and stop loss, you can have your trading platform automatically closing trades for you when they meet your risk management targets;

Technical and Fundamental Analysis

When you trade online, YOU are the only decision-maker. You can open and close trades based on your personal research, studying any investment before you do it.

Educational Courses

Thanks to the huge amount of content available online you have solid material, like the one you find here on TradingOnline.com, to help you in your trading journey;

Trading signals

They can be helpful, even if not all of them are reliable. You should really avoid the ones sent by brokers that make a profit on your losses. We endorse valuable trading signals, but keep in mind that you have to be cautious.

👎CONs of Online Trading

For marketing purposes, everyone seems to only show you the bright side of online trading. We have been in this industry since 2004 and we know just how dark the other side be. But don’t be scared: the pros of online trading are way more relevant than its cons. We are just trying to make you aware of what could harm your path.

- Financial Leverage – It is a double-edged sword. Raising the leverage on your trades can multiply your profits and your losses. We always suggest using low-, or even zero-leverage on your trades;

- Overnight fee – When you keep your trades open overnight, CFDs brokers will charge you a little fee. This is usually very low, but check it up before you choose an online broker;

- Scams – Some people think online trading is a scam, just because there are many scams concerning this topic. Here on TradingOnline.com, we teach you how to tell if someone is trying to fool you and how to avoid getting scammed.

Interesting facts about Online Trading

Let’s discuss some interesting facts about online trading now. This is a very diverse activity, that cannot be shrunk to just choosing the right platform or the right asset.

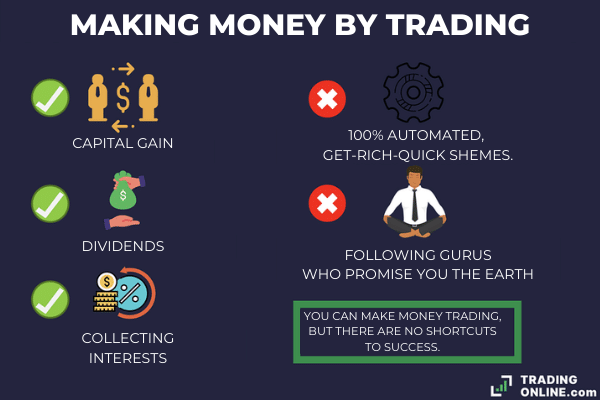

Can you make money by trading online?

You can make money by trading online. It’s just another way to put your capital at work on financial markets, so it can be profitable.

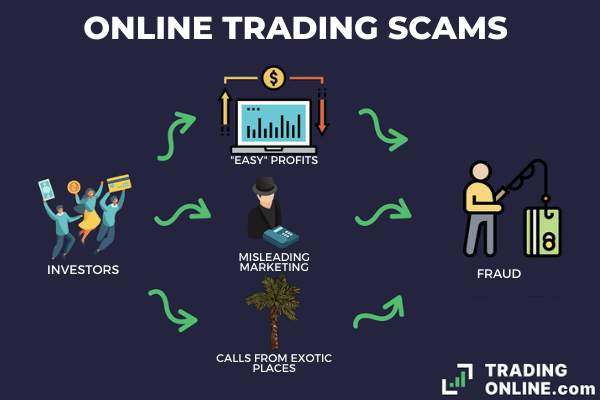

There are plenty of people who could profit from your beliefs about trading online. This is why many online scams try to catch your attention with fancy promises and fake reviews, and everyone seems so willing to make you rich. You need to understand what trading online really is and what it is not.

- Automated methods to make money trading: they do not exist

The old-fashioned scam promising you to get rich with automated trading systems is still quite common.

Let’s make it clear: there is no 100% guaranteed, automatic way to make money by trading online. Of course, trading robots do exist and they can invest our money without our intervention. But always keep in mind that even the best trading robots come with their own risk of losing trades. You can also use CopyTrading (discover more on the eToro website) to replicate the trades of expert investors, but again keep in mind that there is no certainty about profits.

When you come across a scheme that offers you safe and high returns with automated trading, you can tell it is a scam for sure.

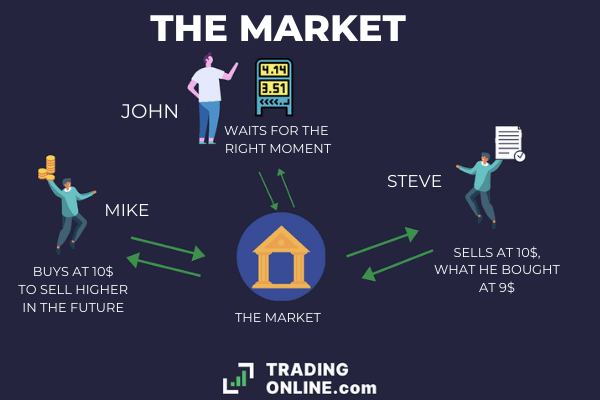

- How can you profit from online trading

Trading implies buying and selling financial assets. We make money every time we sell our assets at a higher price than what we bought them for. This is the reason why millions of people trade on stock exchanges every day. But how much can we make from this kind of trades? Theoretically speaking, there is no upper limit to your profits: just ask people how have bought Amazon or Tesla stocks a few years ago and they will show you how profitable the markets can be.

- How much can you make by trading online?

To get a clear answer we can use the data published from brokers who allow their customers to CopyTrade. Usually, the most popular investors on this kind of platform have an annual return on investment (ROI) of around 20%. This is an empirical figure suggesting that traders who are both profitable and consistent, in the long term, average an annual profit of 20%.

While this is true in the long run, profits can vary widely in the short term. Even the most experienced traders have their highs and lows, both because of their strategies and different market conditions over time.

How much do you need to start Trading Online?

One of the reasons why online trading is so popular is that you can start things off with a very little amount of money. As we said, paper trading is absolutely free; if you want to test yourself using real money, you can start with as little as 50$ with a high-quality broker like FP Markets.

Even if it is possible to kickstart your trading journey with such as small amount, this doesn’t mean you should. The real answer is that you need to start with enough capital to achieve your realistic expectations.

- How much do you need to make a living trading online?

To make a living by trading online you need an amount that is 10 to 20 times higher than your annual need of money. Assuming that you achieve an annual return of 5-10%, which is in line with market returns in the long term, this is exactly how much you need to make sure that your lifestyle can be sustained in the long-term thanks to online trading.

Assuming that your annual expenses are around 35.000$, for example, you would need anywhere between 350.000$ and 700.000$ to be able to make a living trading online. Remember that the more money you have in your trading account, the less risk you need to take in order to achieve the same amount of profits.

If you wanted to be more precise, we should also take into account the effect of inflation. Considering a 2% inflation rate year-on-year, in the long term, this means that to achieve financial freedom with online trading you need to either be in the upper spectrum of the 5-10% return range or have a little more capital in your trading account.

- Investing small amounts of money

You don’t have to think of online trading as your main stream of income. Even if you just invest a portion of your monthly or yearly savings, it can add up over the course of the years. Provided that you have time to let them grow and to keep saving, even small amounts matter.

Theoretically, as we said, there are brokers that allow you to deposit as little as 50$, some even go as low as 20$. Although there are some stocks that you can afford to buy at this price, you have a very limited range of opportunities. It’s not worth the time, in any case.

A new trend that is catching pace rapidly is fractional shares. You basically buy just a fraction of a stock and receive a percentage of its dividends. This allows small investors to create a portfolio with 5-10 different assets for just 200$. If you invest 200$ once, that won’t make a difference in your personal finances. But if you invest 200$ every single month, they will add up and become a long-term investment that you can plan to use in the future.

All in all, it is possible to invest small amounts of money and be successful. Just keep in mind that for small investments to make sense, they should be done regularly over the course of months and years.

How much does it cost to trade online?

Online trading has different pricing based on the kind of assets you trade and the broker you are using to access the markets.

- Spread

Spread is the main cost of any trade carried out using CFDs, but it is still present when you trade directly on underlying assets. A broker will quote you two different prices for any financial asset you can trade: slightly higher to buy and slightly lower to sell, profiting on the difference between the former and the latter.

Keep in mind that spread is not just a way for the broker to profit from trades. A part of it is explained by the way the markets work: when demand and offer for a given asset meet, trades get executed instantly. This means that the highest buy order and the lowest sell order, if they haven’t been executed yet, are slightly different. This slight difference is what creates spread on financial assets.

When a broker operates as a market maker, directly selling you the assets you want to buy and vice versa, it could theoretically apply any spread. A market maker is always the counterpart of your trades, so the broker could potentially set the difference between your demand and its offer. However, competition between different brokers pushes them to quote the lowest possible spreads they can afford.

- Overnight fees

Overnight fees are charged when a CFD trade is carried from one day to the following one. They are usually charged at 11 p.m., subtracting the funds directly from the sum invested in your trade.

You will be charged for any CFD trade, no matter if you operate in the Forex market, the stock market or on any other asset class. Usually this kind of commission is irrelevant in the short term, as it is just a very little percentage of the amount invested (e.g. 0,0075%). If you keep your positions open for months or even years, eventually it will become a considerable cost.

Many brokers advertise their low spread but try to hide their overnight fees. Make sure to check this aspect when you are choosing the platform you want to trade with.

- Fixed commissions

Some brokers charge fixed commissions to their clients. This is especially the case when speaking of DMA trading, while it is uncommon in the world of CFDs. Traditional brokers tend to have higher overhead costs than those that operate 100% online, so they also charge their clients more for every trade they do.

Some online brokers are able to offer access to underlying assets, such as stocks and ETFs, without charging any commission. Their business model is usually similar to the one of a bank, basically profiting from the liquidity deposited on the customer’s account. While this is increasingly popular among traders, only a few brokers have already this zero-commission policy in place.

- For the short term, CFDs are always more convenient

If you are worried that trading fees will erode your profits, CFDs are the most convenient solution for short-term trading. You get charged only with variable costs that depend on the spread and the overnight fee set by the broker. If you plan on holding onto your trades for years, you should consider DMA trading instead to avoid paying high overnight fees.

What do you need to start Trading Online?

Almost anyone can start trading right off the bat. The equipment needed is available to basically everybody. What do you need to start things off?

- A device

It can be a mobile phone, a desktop computer or a tablet. Nowadays trading platforms can fit into any screen, no matter how small it is. The same is true for operating systems: you can run most trading platforms on Windows, Mac, Linux, iOS and Android. Moreover trading platforms are quite easy on your hardware, so you don’t need a powerful machine to run them smoothly. Even if your computer is a few years old, there is nothing to worry about.

- Internet connection

You need an internet connection to trade online, this is quite obvious. Your broker will receive the orders you send through your platform thanks to the connection between your device and its servers.

The speed of your internet connection is no big issue as well. But you do want two things: a stable and reliable connection that won’t give you troubles in the moments when you need it the most, and low ping to the broker’s server. Low ping means faster execution of your orders, which is of course beneficial in some high-volatility occasions.

Remember that if you set a stop loss and a take profit for your trades, they will get closed whenever the price reaches one of the two levels. It is going to happen even if in that particular moment you are not connected to the internet or your device is turned off.

- Education

Studying is crucial for success. Online trading is based upon information and if you are not prepared, you won’t have a chance against professional investors. You can study and get valuable knowledge on websites like ours, or by studying books and courses. You should also consider spending some time on your demo account, to practice before taking the step into real-money trading.

- Initial Capital

You can’t do proper online trading without money. In your early days, you can start trading with a free demo account just to get a taste of the markets and to test yourself. Once you feel ready to get into a real account, you will have to deposit some of your savings into it.

Even though this is something that every trader must do at some point, you don’t need to overexpose yourself. Nowadays brokers accept deposits as low as 20$. Some might ask for a minimum deposit of 200$, but we are still talking of affordable sums overall.

How to stop “trading online calls”?

In recent years, all around the world, we have seen an increasing issue with unauthorized phone calls from online trading brokers. Most of the times, this type of marketing is adopted by scammers. Not only this might be dangerous for unaware investors, but it is also of course very annoying.

All around the world there are different laws regulating privacy and telemarketing. In Europe, for example, strict rules are set in place to prevent citizens from getting called by unauthorized companies trying to advertise their products. Some legislations are more permissive, but there is actually no difference in practice. Any European resident can confirm that even with these strict rules in place, unauthorized brokers and scammers are ever so active in their phone calls.

What you have to understand, is that unauthorized brokers and scammers make most of their money with this kind of promotion. And since they call from exotic locations where it is difficult for authorities to intervene, nobody can actually stop them.

The only real way to defend yourself from unauthorized phone calls is by being proactive, adopting some pieces of software that can detect and stop advertising calls automatically.

- Blocking phone calls with an App

We have tried out different apps to see if any of them could actually help with the issue of unauthorized calls. Eventually, we have found some useful tools that you can use to block incoming calls from online trading illicit promoters.

True Caller: this app can identify marketing phone calls thanks to its huge internal database. You will get notified if any incoming call is associated with a phone number that in the past has been used for marketing purposes. You can also choose to block and report any new number used to call you, so that you will never have to worry about the same number again.

WideProtect Spam Call Blocker: only available on the Apple App Store, this is another great app to defend yourself from trading online scams that promote themselves by cold marketing calls. You can automatically block the prefix of any country, or select any specific number to block.

Remember that call centers will try to call you with a different number if they suspect that you have blocked any of their numbers. This means that you will have more success with True Caller, because it relies on a big internal database that can detect a marketing call even if that number has never called you before.

Is online trading a good investment?

Online trading is different from traditional long-term investments, as it is for the most part made of short and very speculative trades. This is the traditional answer. Lately, though, things have changed quite quickly and online brokers are suited for other kinds of operations as well.

- Speculating vs Investing

When online trading was born, it was very different from now. And what people tell you about this topic is often still affected by the past, when online trading was mostly Forex trading on CFDs with a very high financial leverage. Let’s start from the basics:

- Investing means buying financial assets to profit from their long-term increase in value. Time in the market is the most crucial factor;

- Speculating means buying and selling assets very quickly, to profit from short-term volatility. Market timing is the most crucial factor.

Online trading can now be used both for speculating and investing. You can buy and hold stocks for years, or you can predict the next GDP figure that will affect a Forex pair in a matter of minutes. In its early days, trading online and speculating were almost synonyms: those days are now long gone, and you can just think of online brokers as the gate to any kind of financial asset.

- Strategy is what matters

Now that investing and speculation can be carried out on the same platforms, you can just pick the strategy that suits your vision and apply it to your trades. You can even do both on different occasions, so you basically shouldn’t think of online trading just as a way to speculate.

Think about it: technically even traditional banks and brokers allow you to buy an asset and sell it after a few seconds or minutes. The only reason why retail investors don’t use traditional brokers for speculation is that they would get charged with fees so high they would never turn a profit on their moves.

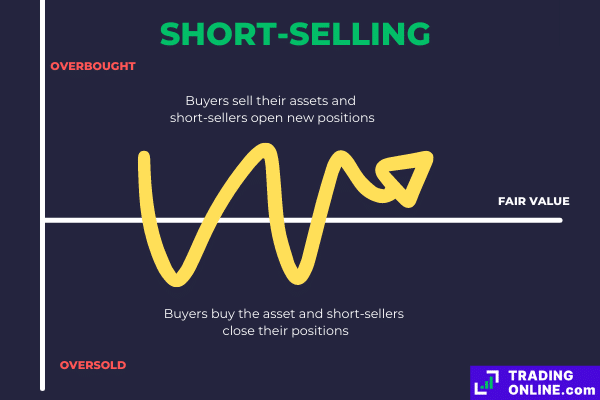

- The case for short selling

Most online brokers allow you to short-sell financial assets. Short-selling has quite a bad reputation on non-specialized media outlets, so part of the population still thinks it is bad. This opinion, however, is ignoring more than 30 years of specialized research and scientific evidence that shows the complete opposite. Short-selling is actually beneficial for the markets, as it enhances market efficiency. The same is true for stocks and all kinds of other equities out there.

Scientific literature in this regard is widely available. If you want, you can check here (a study about the effects of short-selling on the Istanbul Stock Exchange) or here (a scientific review about all available literature on this topic).

Speculation and short selling are not harmful and egoistic activities. They are an important mean to make demand and offer of a certain equity meet at the fair value of the equity itself.

- Speculation and investments: ever so slightly different

Long-term investors and speculators are moved by the same desire to profit from their moves. And their moves affect the markets, making prices go up and down until a financial asset is priced at its right value. This is what is technically called an efficient market.

It makes no sense to think about long-term investors as the “first-class” market movers while considering speculators “bad“. Even short-selling speculators help keep the price of equities at their fair value over time. It was just a matter of time before speculators and investors would find themselves using the same tools. And now it’s just happening, as online trading offers the best fees and conditions to both short speculative trades, as well as multi-year strategic investments.

Studying Online Trading

Training and education are key to the journey of every online trader. If you don’t get to understand how financial markets work and move, you will find yourself struggling not to lose money even when the economy is roaring.

Now the good news: there is plenty of content that you can study to make yourself a more educated and responsible trader. Starting from scratch and moving up to the most advanced trading strategies, you can find great material to study.

- Online trading courses

Online trading courses are very helpful, as they organize their content so that you can gradually learn more advanced stuff without skipping steps or getting confused. But keep in mind that the increasing popularity of online trading has brought in the market a lot of new teachers that aren’t always trustworthy. You’d better choose carefully and double-check the credentials of people trying to sell you their courses.

- Books and eBooks

Old good books and ebooks are always valuable sources of information. “The Intelligent Investor” by Ben Graham, the man who taught Warren Buffett about financial markets and first employed him, is a great example. Even after four decades, it is still a very helpful reading.

Books and ebooks are less subject to makeshift gurus than courses, but they are usually written for readers who already know the basics of financial markets. If you are just starting, try searching for free ebooks published by authorized brokers. They are usually a solid way to understand the basic concepts of financial markets, then you can move on to more advanced books.

- Webinars

Webinars are online classes that teach about one single topic per lesson. Most webinars are not designed to explain basic concepts of financial markets; usually they revolve around the latest news. Provided that you attend webinars where teachers are real experts, they can be very valuable.

- 1-on-1 training sessions

Some online brokers offer 1-on-1 training sessions, in which one of their experts will coach you and guide you to improve your online trading skills. Some even provide this service for free, such as Trade.com. Being able to directly talk to your teacher is the best way to focus on what you really want to learn and on aspects that you think you still need to master. Especially when it comes for free, you should really take advantage of this opportunity.

- Online trading forums

Forums can help you improve your knowledge of the markets. There are many of them, and even on social media it’s now easy to find groups and communities dedicated to online trading. Every new thread can be a good opportunity to learn new strategies and discover new interesting facts. Forums have long been a valuable source of content and they will still be many years from now.

Final thoughts

You have completed the beginners’ guide to online trading. You are now aware of what it is and how it works.

You are ready to move further into this discipline, strengthening your knowledge of more detailed topics.

Online trading is a real opportunity, assuming that you are willing to spend time to practice and learn from proven mentors. ®TradingOnline.com is the official website that allows you to learn anything you need to achieve a full understanding of online trading.

FAQs about Online Trading: frequently asked questions

What is online trading?

Online trading is the whole system of platforms and tools that allows people to invest online in financial markets, using an internet connection and a computer or smartphone.

What can you trade online?

You can trade different currencies (Forex), stocks, bonds, commodities, ETFs, cryptos and more. Some brokers also allow you to trade indexes, options and futures.

What do you need to trade online?

To trade online you only need a computer or smartphone, an internet connection and a small amount of money. But if you really want to succeed, more than anything else you will need knowledge of the topic.

How much does it cost to trade online?

It depends on the broker you choose. Most of brokers now offer a pricing model based on spread and overnight fees (a few cents for every 1.000+ $ invested), or fixed commissions for every transaction.

What are the best trading online platforms?

®TradingOnline.com endorses eToro, Capital.com, FP Markets and Trade.com to trade online. These brokers offer a variety of tradeable assets, convenient trading conditions, and powerful yet easy-to-use platforms.

What stock exchanges allow you to trade online?

You can trade online on almost every market of the world. Directly from your home, you can buy assets listed on Asian, European, American and Australian exchanges. And in all these markets, if you decide to trade online you can enjoy low fees and fast execution of your orders.

Is online trading risky?

Any investment comes with its own risks. Online trading allows you to diversify your portfolio, diluting risk on multiple assets.

What are the best online trading platforms?

The best online trading platform today is the one owned by eToro, thanks to its exclusive social trading and CopyTrading features and zero commissions on shares trading. Then we have MetaTrader, used by FP Markets and Trade.com, which is ideal for automated trading. Last but not least, the trading platform provided by Capital.com with its unique AI features.

Latest news on Online Trading

If you want to stay updated on our latest publications, below you can view the latest contents written by our editorial staff.

We remind you that ©TradingOnline.com publishes only original content, written by expert financial market analysts with over 22+ years of experience, and certified by the competent authorities. © TradingOnline.com is the official portal on Online Trading as well as the first informative item in Italy and available worldwide.

[news]

Online trading glossary

TradingOnline.com has dedicated the final part of this long in-depth study that illustrates the basics of online trading, to the (constantly updated) glossary that collects all the main relative terms that revolve around the world of trading and investments on the online stock exchange.

| Apps for Online Trading | Applications, usually free to download, that brokers set up to allow their customers to trade on mobile. They are available for both iOS and Android |

| Asset | Any financial instrument that you can trade |

| ASIC | The authority regulating Australian financial markets. It is considered one of the most valuable licences that a broker can have to demonstrate its transparency. |

| Ask price | The price that sellers are willing to accept to sell an asset |

| Bid price | The price that buyers are willing to pay to buy an asset |

| Broker | An authorized company that can accept your orders and fulfill them on stock exchanges |

| CFD | Acronym for “Contract For Difference”, they are a popular derivative asset used in online trading. |

| CySEC | Acronym for “Cyprus Securities and Exchange Commission“, it is the authority that monitors online brokers in Cyprus. Most European brokers are regulated by CySEC, which assesses their compliance with European laws. |

| Day Trading | Strategy in which traders open and close their trades within the same trading day. |

| DMA Market | Acronym for “Direct Market Access”, means trading the underlying assets instead of derivative contracts. The best DMA brokers today are Trade.com and eToro. |

| ESMA | Acronym for “European Securities and Markets Authority“, it is the highest authority in the EU that regulates financial markets. All the authorities of Member Countries of the European Union are leaded by ESMA. |

| Hedging | Strategy in which you make one trade to cover the risks of another one. |

| Leverage | A way to increase the money you can invest, by borrowing money directly from your broker or another institution. It is very common in CFD trading. |

| Overnight fees | You get charged with these fees when your trades stay open from one day to the next. They are usually charged at 11 p.m. |

| Platform | The software you use to check price charts, set orders and monitor your portfolio. |

| Pip | The smallest amount by which the price of a financial instrument can change. |

| Rollover | Moving an expiring contract to a future date, which usually implies paying a small fee. |

| SEC | Acronym for “Securities and Exchange Commission”, it is the most important authority in the USA that supervises financial markets. |

| Spread | The difference between the bid price and the ask price of a financial asset. |

| Spread Trading | Similar to hedging, it implies buying one asset and selling a related one to cover the risk of the first trade. |

| Short selling | Selling an asset first and buying it later, in order to profit from a decrease in price. |

| Trader | The investor who trades on financial markets. |

| Trading | Buying and selling financial instruments. |